UK Energy Strategy: Experts weigh in on plans to transform the domestic energy sector

The government has finally unveiled the details of its long awaited energy security strategy, with Downing Street hoping to reduce the country’s reliance on overseas partners and ensure its energy strategy.

The wide-ranging plans include significant ramp-ups of energy generation across the industry – such as:

- Boosting nuclear power from 6.9 gigawatts (GW) to 24GW by 2050

- Raising offshore wind power from 11GW to 50GW by 2030

- Doubling hydrogen capacity up to 10GW from 2030

- Increasing solar power capacity from 14GW potentially fivefold to 70GW by 2035

Ahead of the announcement, City A.M. spoke with energy experts and industry leaders about the strategy and what some of the key sectors needed to bolster the UK’s energy independence.

Breezy does it: Are the wind power plans a load of hot air?

The government’s ambition to develop up to 50GW of offshore wind by the end of the decade would be more than enough to power every home in the UK.

This includes 5GW for deep-water offshore wind farms, which would float in the North Sea.

Downing Street hopes to pave the way for a wind power revolution through planning reforms to cut the approval times for new offshore wind farms from four years to one year.

To achieve this, it wants to radically reduce the time it takes for new projects to reach the construction stages.

Ross Dornan, market intelligence manager at trade body Offshore Energies UK (OEUK) told City A.M. there is “huge potential for wind”.

However, he noted that to meet targets the industry would need to install around 3,000 more new turbines by 2030 – roughly one every day.

Dornan said: “For offshore wind to advance we need a lot of capital investment in infrastructure. In particular, it is crucial that the transmission network is in place to carry the electricity to the centres of demand. That means we need to electrify the North Sea and Irish Sea – creating an undersea grid of electrical cables to carry power from offshore wind farms to the UK’s towns and cities.”

He also said there needed to be “collaboration across environmental assessments” and “fast-tracking of the consenting process” to ensure the funds and enthusiasm for offshore wind did not go to waste.

RenewableUK’s chief executive Dan McGrail argued the government needed to maximise the amount of capacity secured at its “annual competitive auctions for clean power.”

Meanwhile, the plans do not include targets for onshore wind.

This is despite media reports suggesting a potential doubling of onshore wind from 14GW to 30GW, which would be achieved by reducing the ability of local authorities to reject turbines.

While Business Secretary Kwasi Kwarteng was reportedly in favour of planning reforms, the idea faced opposition from other cabinet members such as Transport Secretary Grant Shapps and Work and Pensions Secretary Therese Coffey.

Instead the government has announced it “will be consulting on developing partnerships with a limited number of supportive communities who wish to host new onshore wind infrastructure in return for guaranteed lower energy bills”.

However, McGrail has called for onshore wind to be ramped up through planning reforms.

He said: “We also need to see reforms the planning system to remove unnecessary barriers which are delaying much-needed new British energy infrastructure, to allow projects to go ahead in areas where they have local community support.”

This outlook was shared by Octopus Renewables and industry body Energy UK, which have both called for planning reforms in recent weeks.

North Sea: Is oil and gas a fossilised industry?

The government has announced a new licensing round for North Sea oil and gas projects planned to launch this autumn, with a new task-force set offer “bespoke support to new developments.”

The industry has enjoyed a revival in interest over recent months, with Kwarteng encouraging further fossil fuel exploration in the North Sea – with Shell reportedly reconsidering its withdrawal from the Cambo oil site off the Shetland coast.

Meanwhile, rebounding post-lockdown demand and rallying oil and gas prices has seen both BP and Shell revel in record dividends, resulting in fresh calls from Labour for a windfall tax.

Prime Minister Boris Johnson hosted a roundtable last month to discuss bolstering domestic production, aware of gas’ role as a bridging supply.

With the country in need of gas over the short-to-medium term, securing it domestically would be savvier in geopolitical terms and less environmentally damaging.

City A.M. understands there are two government pathways for reducing the UK’s carbon emissions over the next 15 years.

There is the Beis “Delivery Pathway” which entails a six per cent average annual decline in both oil and gas, and the CCC “Net Zero Balanced Pathway” suggests an average annual decline rate of six per cent for oil and five per cent for gas.

Both scenarios reinforce the extent to which oil and gas will be used in future years.

However, the need for funding to go alongside intentions is apparent – with OEUK gloomily forecasting a significant decline in North Sea oil and gas without domestic investment.

Dornan explained: “We are already net importers meaning we must source these fuels from all over the world and the proportion of imports is likely to grow unless we invest in the North Sea and UK Continental Shelf. However imported oil and gas tend to have a bigger carbon footprint. Overseas sources are also less secure – as shown by the energy crisis linked to the Ukraine invasion.”

Andy Mayer, energy analyst at the Institute of Economic Affairs (IEA) criticised the government’s “ideological approach to Net Zero” through carbon and production targets.

Speaking to City A.M., he said: “The government has caused a collapse in North Sea investment. They need to deregulate, simplify taxes, and get out of the way. Private companies will invest in stable markets, not unstable regimes subject to constant interference. More drilling, less banana republic climate politics.”

The Nuclear Option: Fission for opportunities

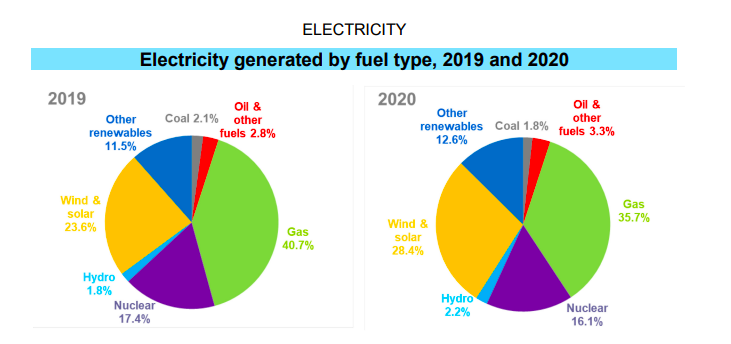

Currently, the UK has six generating (6.9 GW) nuclear power stations, providing around 16 per cent of the country’s electricity

Nuclear power has saved the UK 2.32bn tonnes of carbon emissions, this is equivalent to all of the country’s emissions from 2015 through 2020.

This saving is far more than any other source, however the current of nuclear plants is ageing and in need of upgrades.

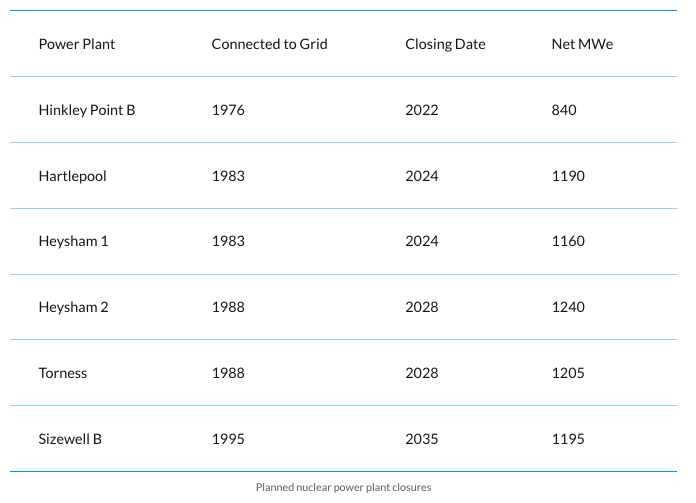

Three stations will retire by March 2024, and all but one will be closed down by the end of the decade.

Consequently, Johnson is calling for a “big new bet” on nuclear, and has won the Chancellor Rishi Sunak over to his side with pledges to near quadruple generation levels.

This would boost energy generation from nuclear to around 25 per cent of the UK’s projected electricity demand.

Small modular reactors being developed by Rolls-Royce would form a key part of the nuclear project pipeline, alongside light water reactors such as Hinkley Point C and Sizewell C.

A new government body – Great British Nuclear – will be set up immediately to bring forward new projects.

Downing Street is also set to launch the £120m Future Nuclear Enabling Fund later this month.

This could mean delivering up to eight reactors, equivalent to one reactor a year instead of one a decade.

Tom Greatrex, chief executive of the UK Nuclear Industry Association, was pleased with the targets, which he argued would “revitalise a world class skills base right here in Britain”.

He called on the government to make nuclear eligible for green bonds and for money from the promised Future Nuclear Enabling Fund allocated at pace, with good sites being made available for project development.

Nevertheless, there are questions over the viability of the plans – with Hinkley Point C well over budget, reportedly costing £23bn.

It has also been delayed until 2026, while Sizewell C remains in the early stages.

Mayer was also sceptical of the prospect of nuclear power being ramped up to meet energy demands – citing the costs.

He explained: “We still pay today for the failure of British nuclear policy in the 20th century, the probability of a repeat is high. The government’s impact assessment report for the Nuclear Financing Act expects us to pay £24-63bn for each new power station and for each to take 13-17 years to build. These costs will be added to bills immediately, alongside a taxpayer subsidy from a Government stake. While other nuclear options exist, they are as yet unproven, and by the time they’re built renewable and storage options may be better and cheaper.”

This reflects the challenge for nuclear – the bet requires heavy funding and operational proficiency which so far remains elusive.

Cost-of-living crisis continues

While the bolstering of the UK’s energy sector will be vital to reducing its reliance on overseas supplies, including Russian hydrocarbons, its effect on energy bills is likely to be felt in the medium-to-long term.

Soaring gas prices have driven up wholesale prices, and breaking the link between the two will require many further years of investment.

The terms of increasing renewable investment also had to be considered, with too much reliance on public funds likely to lead to higher tax bills which would minimise the value of cleaner cheaper energy.

Michael Grubb, Professor of Energy and Climate Change & Deputy Director, UCL told City A.M.: ““The renewables, in life-cycle costs, are much cheaper than what we are currently paying for electricity, so in the long run they can certainly bring bills down – but it’s a hell of a lot of new investment, so the nearer term impact on bills will all depend on the financing terms of such investment.”

Emma Pinchbeck, chief executive of industry body Energy UK, argued the “quicker we can expand our own sources of cheap domestic clean power, the quicker we can reduce the effect of volatile international gas prices on customer bills”

She highlighted that wind and solar can be deployed quickly over the next year or so if they have consent or planning permission.

However, it was unlikely to ease the current prices facing consumers – with the price cap hiked to nearly £2,000 per year amid market instability which has caused nearly 30 suppliers to collapse.

Pinchbeck concluded: “Realistically, though, any new energy projects will not be built fast enough to make a difference over the next few months, which is why Government needs to look again at the existing support package for customers, given projections of further bill rises later this year. ”

NOTE: Comments were made in the run-up to the strategy unveiling, based on reported targets.