UK corporates weakened by strong sterling

FIRMS listed on the FTSE 100 fell victim to the UK’s own success as the internationally focussed index saw revenues suffer on the back of strong sterling according to the latest Profit Watch UK report by analyst firm The Share Centre.

The domestic UK economy sprung to life last year growing by 2.6 per cent, making it the world’s fastest-growing major advanced economy.

The strong growth came at a price for some of the UK’s biggest companies, however, as strong sterling, coupled with a decline in commodity and oil prices, hit the mega companies, many of whom transact in dollars but report in sterling.

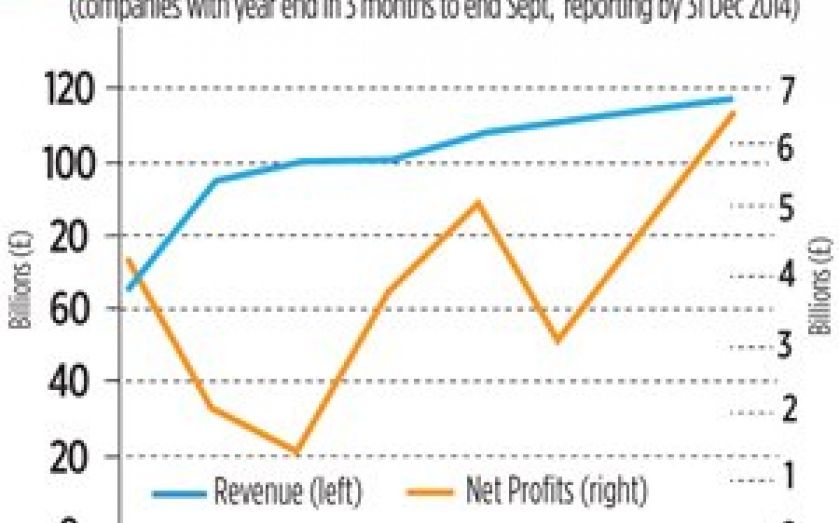

The report found revenues among the FTSE 100 declined 2.1 per cent, with Thomas Cook and Imperial Tobacco leading the way with declines of eight per cent and six per cent respectively.

The findings, which correspond with the year ending September 2014, are in sharp contrast to the backdrop of 2013 when the effects of QE and a downgrading of the UK by Fitch in February meant the pound was one of the worst performing currencies of the year.

Recent results showed both companies continuing to struggle in the new year. Overall the report claimed the strength of sterling knocked £2.7bn from the top lines of companies during this period. The strength of the domestic economy translated in to a 30 per cent increase in net profits at the 350 level.