The Bloodbath – fancy a sip?

Ever watched a vampire movie? There’s always this old and wise vampire that is leading the pack. He is slowly sucking innocent people’s blood and even other vampires can not withstand or challenge him. Up until then his confidence (or arrogance) becomes his enemy, and a new breed comes to take over his place.

We were just harvesting seasonal goodies for dinner, while the vampire action movie was taking place just in front of our DeFi eyes. Have you missed it?

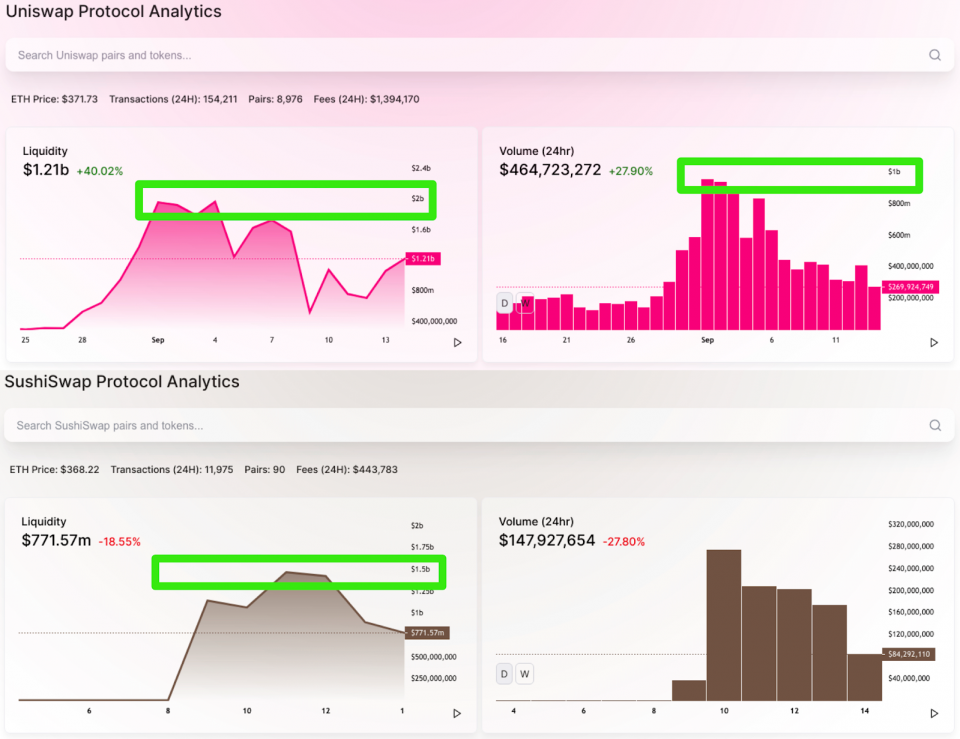

DeFi space is evolving at the speed of a silver bullet, as though fired from Blade’s (Wesley Snipes) Mac 11 machine gun. Just a few weeks ago decentralised exchange (DEX) Uniswap was taking over crypto trading volumes by storm. Topping nearly 2 billion in locked liquidity and 1 billion in trading volumes, it’s surpassing some of the major legacy exchanges like Coinbase. Up until the 28th of August, this is when the new project, Sushi, swap came out. The project gained traction in the DeFi community very fast as it is a fork of Uniswap, and it’s main objective was to directly compete with it by sucking out the liquidity using the process that was later called a “vampire attack”. SushiSwap’s goal was to create a community governed automated market maker and impartially distribute its native token SUSHI.

The idea behind a ‘vampire attack’ is fairly simple – create very strong incentives for liquidity providers (LP’s) to migrate by moving their liquidity to a new platform. Firstly liquidity providers are incentivised to move their staked liquidity provider (LP) tokens to a new platform. In this case, Uniswap LPs were incentivised to move their LP tokens to SushiSwap so they can receive extra rewards in SUSHI tokens. SushiSwap started with quite an aggressive emission of SUSHI tokens to make the incentives so mouth watering that it would be hard to resist. 1000 SUSHI tokens were distributed per Ethereum block to Uniswap LP’s across multiple different pools that included YFI-ETH, LINK-ETH, LEND-ETh and others. The idea was successfully used previously by another yield farming project YAM and was now re-used by SushiSwap.

Once enough liquidity is attracted to a new protocol, the next step of a vampire attack is to migrate staked LP tokens to a new platform. By doing this, the new platform now can use LP tokens for their own automated market maker by stealing both – the users and the trading volume. The liquidity has been sucked out from the first platform, hence the name – “vampire attack.” That’s where the ‘masterchef’ contract played its role. Once liquidity from Uniswap was sucked out, it was instantly used to trade on SushiSwap. To maintain the liquidity after the migration, additional incentives were created – 100 SUSHI per Ethereum block was distributed. On top of that, those who decided to stake their SUSHI instead of selling it, would be getting a chunk of trading fees from SushiSwap. At the end of a successful ‘vampire attack’ the vampire ends up sucking out the liquidity, users, and trading volume.

Sneak Attack!

The situation got even more interesting when crypto exchange giant Binance stepped in to the game and listed SUSHI token in an attempt to maintain users and trading volume. SushiSwap had not only successfully sucked out liquidity, users and trading volume, but now it was receiving more support from the community and very well known figures from the industry. Following that, SushiSwap creator added some drama to the story – he sold his stake of SUSHI tokens worth around 14 million USD and created a lot of anger and confusion within the community. Just after a few days, announcing that he is returning all the funds and coming back to developing the project. Our popcorn is popping and the movie is on, we are excited to see what is coming next.

Quality information is what will give you a competitive edge in this rapidly changing market. DeFi Insiders MSH are a group of experts working in the heart of the movement. This is a live reflection of what is happening on a day to day basis. Nothing written in this article constitutes financial advice and does not reflect either the views of City AM or those of Crypto AM.