Signet moves share listing to New York

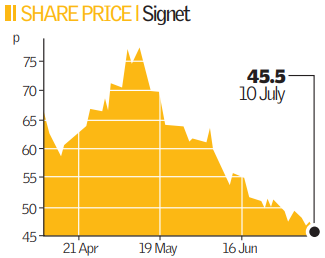

Jewellery giant Signet Group yesterday announced it would move its primary listing to the New York Stock Exchange, as part of a raft of changes to focus its business on the American market.

The jeweller, which owns the H Samuel and Ernest Jones chains in the UK, said it hoped to complete the move – expected to cost around £5m – in early September. It will also apply for a secondary listing of its shares in London.

Signet, which makes around 70 per cent of its revenues in the US, said it had consulted with its investors extensively before making a decision. Shareholders will get a chance to vote on the proposals in early August.

The firm is also planning to move its domicile to Bermuda to avoid the adverse tax implications of being domiciled in America. Firms listed on the NYSE cannot be domiciled in the UK.

A spokesperson said the firm would retain its London headquarters, and that it remained committed to its British chains and employees. As part of the proposals, Signet is proposing a reverse stock split at a ratio of 20 shares to 1, so it can trade at a price more comparable to other mid-market American jewellers. Around 4 per cent of investors, who own less than 20 shares, will be bought out.

The jeweller also hinted that it would reduce the dividend it pays its stockholders. “If you look at other jewellers in the US, they tend to pay out a ratio between 20 and 25 per cent, compared to the 44 per cent we pay currently,” a spokesperson said.

Declining consumer confidence on both sides of the Atlantic and an increase in the price of gold have led to tough times for the retailer. Signet, which was formerly named Ratner, changed its name in 1994 after former chief executive Gerald Ratner said the firm’s products were “totally crap” and compared a line of earrings to a 99p prawn sandwich.