Saudi Aramco unveils £36.8bn profits powered by soaring gas prices

One of the world’s largest companies, Saudi Aramco (Aramco), has revealed jaw-dropping profits of £36.8bn ($42.4bn) for its third quarter of trading.

The oil and gas titan reported its second-highest ever earnings as listed company, surpassing analyst expectations with gas prices climbing to record highs amid a Russian squeeze on supplies and concerns over shortages.

Its vast earnings were down on the record profit of $48bn between April and June, but up around 40 per cent year-on-year.

This reflects a slide in oil prices over the summer, which have still gained 20 per cent this year, and a hike in royalty rates for products.

Overall royalties and other taxes more than doubled year-on-year in the third quarter to $24.3bn, from $10.48bn last year.

Nevertheless, the company’s performance over the calendar year is among the most lucrative in business history, clocking in at around $130bn for the first nine months of trading.

Chief Executive Amin Nasser said: “Aramco’s strong earnings and record free cash flow in the third quarter reinforce our proven ability to generate significant value through our low cost, lower-carbon intensity upstream production and strategically integrated upstream and downstream businesses.

“While global crude oil prices during this period were affected by continued economic uncertainty, our longterm view is that oil demand will continue to grow for the rest of the decade.”

Aramco has maintained its dividend, the world’s largest, unchanged at $18.8bn for the quarter.

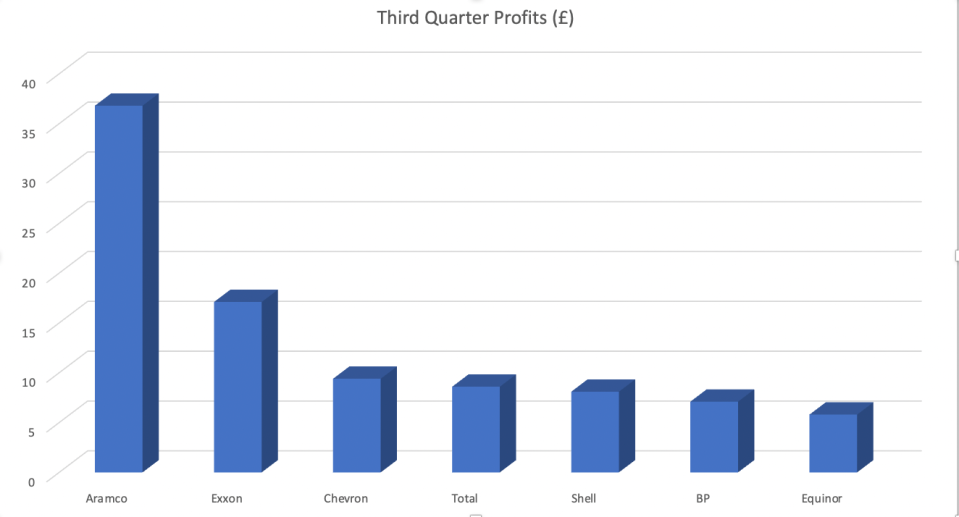

Its massive earnings follow bumper profits from rivals BP, Chevron, Exxon Mobil, Equinor, Shell, and Total Energies.

The company is also the biggest provider for key OPEC member Saudi Arabia – which has been at loggerheads with the US after its extended group cut oil output by 2m barrels per day this month.

Last month, Nasser raised his frustrations with the drop in oil prices over the summer, which he argued reflected a market overly-focused “on short-term economics,” with multiple developed economies expected to drop into a recession.

Speaking at the Energy Intelligence Forum in London, he said: “(The market is) focusing on what will happen to demand if recession happens in different parts of the world, they are not focusing on supply fundamentals.”