Russia using cryptocurrencies to avoid sanctions – reality or myth?

Months ago, the Central Bank of Russia proposed a blanket ban on cryptocurrency trading and mining, listing many reasons. The Central Bank was emphatic in its warning, saying that cryptocurrency mining entailed significant risks for the country’s economy and financial stability. The President, Putin, however, appeared to be less sure, denoting that Russia had advantages in cryptocurrency mining due to its huge energy wealth and expertise in the field. His doubts about a full crypto embargo might well have deepened after the wave of sanctions-hit Russia.

The economic sanctions imposed on Russia for invading Ukraine are naturally causing harm to the Russian economy. Their intended target, though, is to hit Putin and the Russian oligarchs who support his rule where it hurts most. This strategy aims to prevent these individuals from using or moving their wealth around by freezing the assets they hold overseas and blocking financial transactions.

However, the continued operation of cryptocurrency exchanges in Russia is worrisome to US officials. Russia and its banks could be looking more closely at cryptocurrencies because they could represent an alternative medium of international exchange to the dollar.

Could this be a good way for Russia to boycott sanctions?

Elizabeth Warren, a US Senator, recently called upon US regulators, sharing her concern that “cryptocurrencies risk undermining sanctions against Russia, allowing Putin and his cronies to avoid economic pain”.

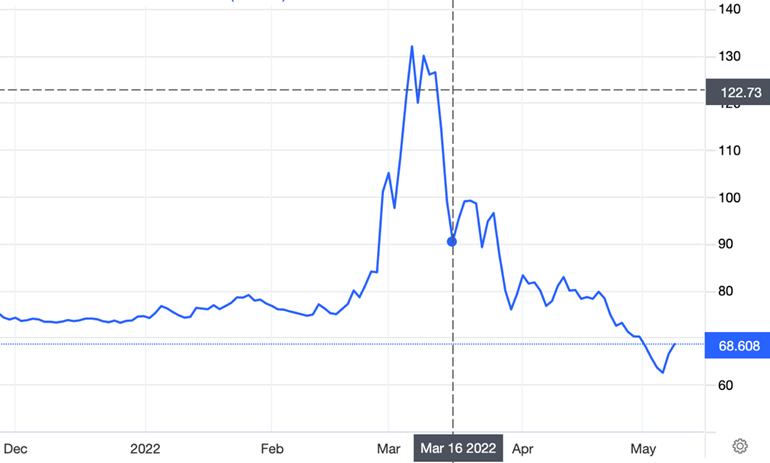

Since the wave of financial sanctions hit, trading between the Russian rouble and various cryptocurrency assets has been noted to have spiked, rising above double. The scale however suggests that buyers are ordinary Russians seeking to hold on to their savings as the value of the rouble initially crashed. Although there has been a recovery in the value of the rouble since it reached a low of over 140 to the US$

US$ v Russian rouble

Why cryptocurrencies? Would using them to avoid sanctions be effective?

Cryptocurrencies were designed to be free from central financial authorities such as governments, banks, and central banks. They enable peer-to-peer (P2P) transfers that could be carried out without any intermediaries. Due to this advantage, sanctioned individuals and countries such as Russia could subscribe to the use of cryptocurrencies to shore up their assets and continue making international payments.

Another feature of cryptocurrency that regulators and central banks dislike is its ability to bypass the international banking system which is crucial to enforcing sanctions acting. The international banking system in effect acts as a listening post for financial transactions worldwide, but potentially crypto transactions offer an alternative way to make irreversible cross-border transactions.

However, the question of how effective this would be has to be asked. Russia would have to harness cryptocurrencies at a substantial scale to remarkably lessen sanction’s impact.

According to Trading Economis.com: “With 144 million people and a GDP of $1.5trn, it is unsurprising that Russia is a key player in global trade. It is the 14th-largest global economy by goods exports – exporting $337bn worth of goods. Russia runs a trade surplus, with its goods imports totalling $232bn.”

Therefore it would be difficult given these trade numbers for Russia to effectively switch from using the Ruble, $, Yen,€, £ etc., to a basket of cryptos . The moving cryptocurrencies in large quantity would easily be noticed; the transparency that cryptocurrencies afford would expose Russia, making it possible to identify and shut down Russian sanction evasion.

Challenges of using crypto to avoid sanctions

Transactions traceable: Despite cryptocurrency’s function on a decentralised system, its transparency makes it difficult to move capital and transfer value in large quantities. The majority of cryptocurrency transactions are recorded on a publicly available blockchain ledgers: the ledger of activities can be traced, thereby exposing the transactions and making it possible to identify and stop sanctions evasion. Chainalysis affirmed that the cryptocurrency sector has the tools to prevent sanctioned individuals from escaping detection.

Exchanges are on high alert: Although cryptocurrency exchanges are yet to be legally mandated to block Russian users as a whole, they have agreed to comply with sanctions. Exchanges such as Coinbase, Binance and Kraken have said they have a means of differentiating between the Russian politicians who start wars and the normal people, many of whom do not agree with war. This will make it very difficult for Russian elites to make transactions on those exchanges.

Looking at these, it would therefore be agreed that crypto isn’t a significant escape route for sanctioned individuals.

Could there be a way out?

Last year, North Korea hacked crypto platforms, raising about $400m, as reported by Chainalysis. This same route could be used by the Russian elites to avoid sanctions.

If the Russian government is bent on boycotting sanctions using cryptocurrencies, another thing they could do is try to develop a network of complicit exchange services that would help conceal crypto ownership. There are also cryptocurrencies that are hard to trace, and an example is the privacy-focused Monero.

Although there are speculations and suggestions that the Russian actors might have turned to crypto as a means to boycott the financial sanctions, whether or not Russia is using cryptocurrencies to avoid sanctions is yet to be confirmed.

Although the EU is taking the threat serious as they have recently targeted digital wallets held by Russians as part of the Europe’s on going sanctions against Russia. However, there are challenges in the use of cryptocurrencies to circumvent financial sanctions and possibly the bigger concern for some will be the impact of Russian sanctions on the crypto industry .