Rosebank: All systems go for new North Sea oil and gas field after joint thumbs-up

The Rosebank development, the first major new oilfield in the North Sea for many years, will go ahead after private investors and government both signalled final approval.

Equinor and Ithaca Energy will invest around £3bn in the project which was finally given government go-ahead this morning.

The project is the largest undeveloped field in the North Sea and is expected to lead around £8bn-worth of investment.

Approval was received from the North Sea Transition Authority this morning – with the project passing environmental hurdles from regulators.

“We have today approved the Rosebank Field Development Plan which allows the owners to proceed with their project,” the NSTA said.

Located around 80 miles north of Shetland, the field is expected to deliver around 200m barrels of oil in ‘phase one’ – with majority shareholder Equinor aiming to begin production at the site by 2026.

Both companies have now begun the process of signing up engineering firms for the complex drilling project.

Equinor has an 80 per cent stake in the site and is overseeing the project, with Ithaca owning the remaining 20 per cent.

The project has been controversial with campaigners pushing government to scrap new licences in the North Sea.

However sources told City A.M. over the summer that the project was likely to get the thumbs up from government as it attempts to secure more reliable domestic energy supplies.

Geir Tungesvik, executive vice president of projects, drilling and procurement at Equinor, said: “Developing the Rosebank field will allow us to grow our position as a broad energy partner to the UK, while optimising our oil and gas portfolio, and increasing energy supply in Europe. Rosebank provides an opportunity to develop a field within the UK Continental Shelf which will bring significant benefits to Scotland and the wider UK.”

Gilad Myerson, executive chairman, Ithaca Energy, commented: “We are delighted to announce the decision to move forward with the Rosebank development alongside Equinor.

“Rosebank stands as the largest undeveloped field in the UK, and with the receipt of development consent from the NSTA, we are now poised to embark on a journey that will not only provide critically important domestic energy but also ignite substantial economic impact.”

The government backed the regulator’s decision this morning – which has included oil and gas exploration in its energy security strategy.

Energy Security Secretary Claire Coutinho said: “We are investing in our world-leading renewable energy but, as the independent Climate Change Committee recognise, we will need oil and gas as part of that mix on the path to net zero and so it makes sense to use our own supplies from North Sea fields such as Rosebank.

“The jobs and billions of pounds this is worth to our economy will enable us to have greater energy independence, making us more secure against tyrants like Putin.”

Its approval has also drawn criticism from climate activists and energy transition groups,

Tessa Khan, executive director of Uplift argued the decision proves Rishi Sunak “couldn’t care less about climate change.”

“As we’ve heard repeatedly, our world can no longer sustain new oil and gas drilling. And when we’re witnessing scorching temperatures, wildfires, devastating flooding and heatwaves in our seas, it could not be clearer that this is a decision by the Prime Minister to add more fuel to the fire,” she said.

Green Party MP Caroline Lucas said: “Giving the green light to this huge new oil field is morally obscene. This Government must be held accountable for its complicity in this climate crime.

Ed Miliband, Labour’s shadow climate and net zero secretary, has previously criticised the project – warning it would not help to drive down energy bills.

However, opposition leader Keir Starmer confirmed this summer that his party would only ban new oil and gas licences and would not retroactively cancel approved projects if Labour wins the next election.

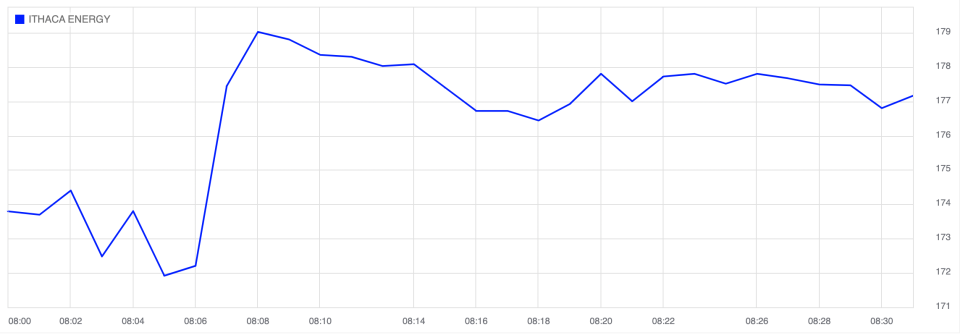

Following today’s announcement, shares in Ithaca Energy have soared on the FTSE 250 – rising 8.5 per cent this morning to 177p per share.