Return Finance launches fully compliant high-yield savings application in 27 European countries

Fintech company Return Finance has been granted Virtual Asset Service Provider (VASP) authorisation from regulatory authorities to operate in 27 European countries.

The authorisation allows the company to provide digital asset services to customers in the region, including the exchange between virtual assets and fiat currencies.

The Return app offers an annual percentage yield (APY) of up to 10% on deposits, rather than conventional options with minimal interest rates, by leveraging the power of trusted DeFi protocols like Curve and Convex Finance among others to provide users with a secure platform.

Users can track the progress of their funds and monitor growth. Return uses USDC, a regulated token backed by the United States Dollar 1:1, to provide stability.

The company has partnered with recognised industry leaders such as Moonpay, Circle, CYBAVO, Chainanalysis and SumSub.

“We are thrilled to receive our VASP authorisation which is a testament to Return’s commitment to compliance and customer protection,” said Daniel Ishag, CEO of Return Finance.

“We believe that regulation is key to the growth and maturity of the digital asset industry, and we welcome the opportunity to work with stakeholders to build a safe and thriving ecosystem for all. Our fully compliant high-yield savings product is a great first step that will make high-yield savings accessible to all.”

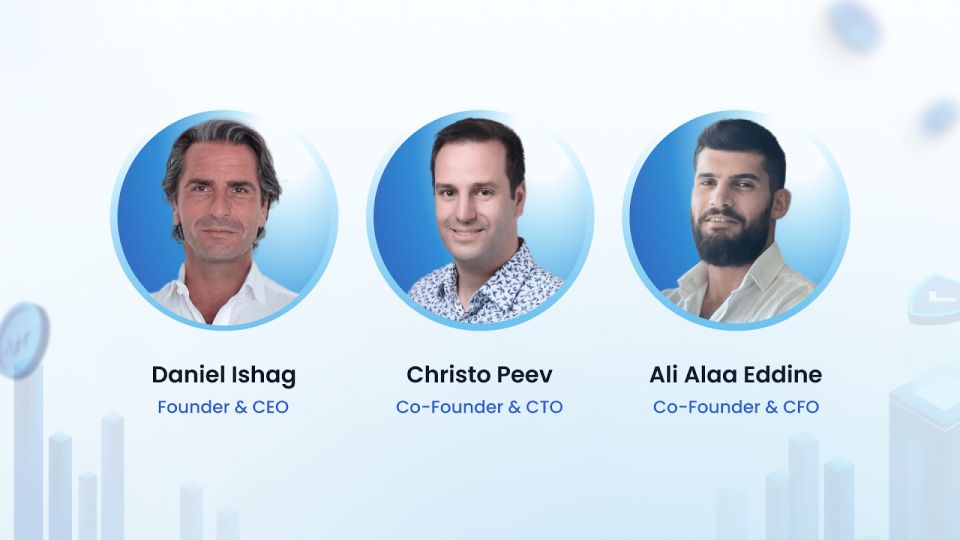

With more than 25 years of experience, serial entrepreneur Daniel Ishag, the founder and CEO of Return Finance, is renowned for his endeavours in pioneering new business models and creating products and services that have achieved remarkable levels of adoption.

The founding team also includes industry veterans with deep technical backgrounds in distributed ledger technology (DLT).

Return Finance is aiming to democratize the advantages of DeFi by creating an easy-to-use, accessible, and intuitive platform.

To learn more about Return Finance, visit https://return.finance/.

About Return Finance

Return Finance was established with a mission to provide individuals and businesses with high-yield savings products in a fully regulated, transparent, and decentralized manner. With a commitment to accessibility and security, the company offers its services through the Return app, aiming to democratize the adoption of decentralised finance.

About Daniel Ishag

Daniel Ishag is the founder & CEO of Return Finance. As a long-standing serial entrepreneur, he possesses proven experience in scaling businesses and building global client bases. In his career, he has launched multiple businesses, such as Espotting, Karhoo, and Bluewater Bio, all with the aim to deliver innovative services. Daniel also holds multiple advisory roles in global tech companies, VCs, and family offices. In recent years he has developed a deep understanding of DLT technologies and their application.

About Christo Peev

Christo Peev is the co-founder and CTO of Return, possessing a deep-cut knowledge of software development and blockchain technologies, as well as a never-ending drive for innovation. His successful company Motion Software, whose mission is to help empower talented software developers in remote parts of the world, recently got acquired by Exadel, where he became EVP & Global Head of Innovations.

About Ali Alaa Eddine

Ali Alaa Eddine is the co-Founder & CFO of Return Finance and a senior finance specialist, CPA, and tax advisor with over a decade’s experience in financial services, audit, and advisory services. Most of his career experience comes from working with PricewaterhouseCoopers (“PwC”), where has provided external audit, forensic accounting, capital markets advisory, valuation, and regulatory reporting services to banks, international, private, and publicly listed companies, such as JP Morgan, Credit Agricole, HSBC, Moody’s, Dubai Financial Markets, AXA Insurance, and many others during his tenure. Recently Ali has broadened his horizons in the entrepreneurial areas of Crypto and DeFi.

About Return’s partners

MoonPay is a fintech platform that bridges traditional finance and DeFi, offering users the chance to buy digital currencies with ease. The company has a global presence in more than 160 countries, where it offers a safe and compliant operation. MoonPay is trusted by 300+ leading wallets, applications, and websites around the globe.

Circle is a prominent company that offers a range of innovative financial services and solutions in the DeFi space. With a focus on building a more inclusive and accessible digital economy, the company has firmly established itself as a front-runner. It has also played a significant role in the development of USDC, a stablecoin pegged to the US dollar, which has gained widespread adoption and is recognized for its transparency and regulatory compliance. Its innovative solutions and commitment to driving mainstream adoption of cryptocurrencies have positioned Circle as a key player in shaping the future of digital finance.

CYBAVO is a reputable fintech that provides secure and scalable solutions for the storage and management of digital assets and cryptocurrencies, as well as a comprehensive suite of enterprise-grade products and services. With a strong emphasis on security, reliability, and regulatory compliance, it has earned the trust of financial institutions, crypto exchanges, and enterprises worldwide. Their expertise and dedication to providing cutting-edge solutions make them a trusted partner for those seeking to navigate the complexities of the digital asset landscape securely.

Chainalysis is a leading blockchain analytics company that specialises in providing investigative and compliance solutions for cryptocurrency transactions. Their solutions help enterprises meet regulatory requirements and ensure transparency. With a wealth of expertise and extensive data coverage, Chainalysis offers actionable insights and intelligence to support law enforcement agencies in combating cryptocurrency-related crimes. The company plays a vital role in fostering trust, security, and legitimacy within the digital asset space.

SumSub is an identity verification company specialising in digital business solutions. Its advanced platform offers efficient customer onboarding and KYC processes, leveraging biometric checks, document verification, and facial recognition technologies. With a strong emphasis on regulatory compliance and fraud prevention, SumSub caters to various industries, including fintech, DeFi, and e-commerce. Known globally for its reliability and accuracy, SumSub enables organisations to build trust with customers, prevent fraud, and ensure a seamless user experience.