Relentless

Surging Higher

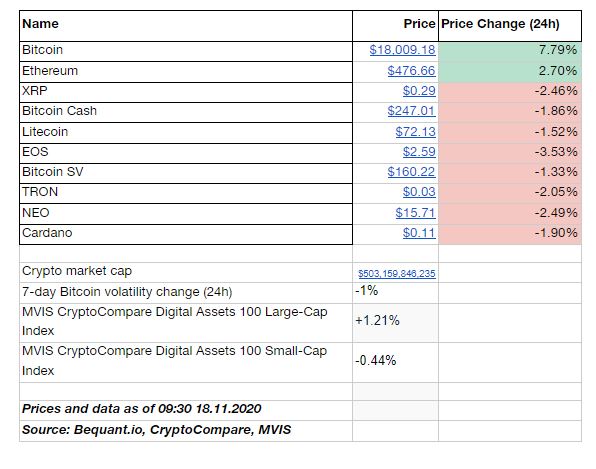

Bitcoin continued its relentless surge higher and after breaching the $18,000 level, the upside temporarily stalled at $18,500, but the dip buying interest was so strong that the dip into the low $17,000 was brought-up without any hesitation. The path towards an all time high is very much in sight.

Similarly, Ethereum also faltered ahead of the $500 level and dipped into the mid-$400 zone before promptly recovering. Another day and another record high open interest (OI) across the futures venues. The trend of stablecoin margined products eating into the market share of Bitcoin margined venues is also expected to gather more momentum.

In the Markets

DeFi on the Dazzle

With that in mind, the OI on the CME finally topped the big $1bln mark. Looking at other parts of the digital asset ecosystem and the yield hungry market participants were largely unfazed by the prospect of Bitcoin heading through an all time high and instead looked carefully for opportunities to put their capital to work.

As noted earlier in the week, the conclusion of the first farming round by Uniswap resulted in liquidity on the protocol to halve from its peak of $3.3bln. Some of this liquidity moved over to Sushiswap, where the total liquidity now stands at just over $1bln. This is a continuation of the superb performance of the DeFi sector during 2020.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on ByteTree Asset Management