‘Expensive triple lock’ needs to be reformed to get UK finances in order, OECD says

The government should reform the state pension ‘triple lock‘ to help get the public finances back on a sustainable path, according to the Organisation for Economic Co-operation and Development (OECD).

In a report published last week, the OECD warned that the government needed to take “significant action” to stabilise the public finances.

Public expenditure is expected to be 2.9 per of GDP higher by 2028-29 than it was before the pandemic, largely as a result of higher health costs and the “expensive triple lock”.

“The current fiscal trajectory is unsustainable in the long term,” the Paris-based organisation said.

“There remains little room for further cuts to public services after a decade of spending cuts in real terms. However, spending related to the triple lock for state pensions could be reduced,” the body said.

Under the so-called ‘triple lock’, the state pension rises each April in line with whichever is highest of inflation, average wage increases or 2.5 per cent.

Labour has committed to keeping the triple lock in place at least for the duration of this parliament despite concerns over its sustainability.

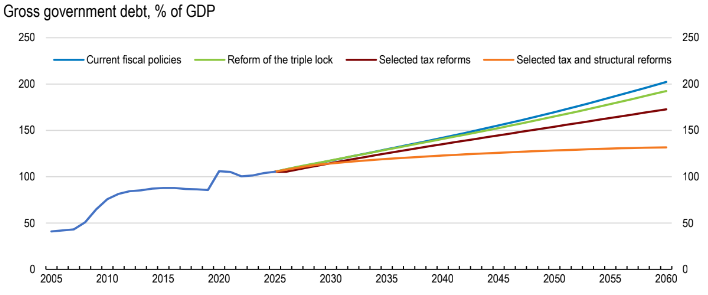

According to the OECD, the policy is projected to add around eight per cent of GDP to public debt by 2072-73. That increase comes despite the state pension age rising to 67 in 2028, up from 66 currently.

In its place, the OECD suggested that pensions rise alongside an average of CPI and wage inflation, while providing direct transfers to poor pensions to mitigate against poverty risks. This would “help to contain public debt somewhat”.

Alongside cutting back on support for pensions, the government should conduct a “comprehensive tax review” that attempts to make the overall tax system fairer.

“There is scope to mobilise additional tax revenues as numerous exemptions and reliefs make the tax system difficult to navigate, while their effectiveness is uncertain,” it said.

A range of reforms were recommended, including raising council tax, simplifying the income tax system and reducing the tax deductibility of firms’ interest bills.

The report comes as Rachel Reeves prepares her first Budget as Chancellor. She has warned of “difficult decisions” in the fiscal event, with some analysts expecting the Chancellor to announce tax rises worth some £20bn.

Capital gains tax, inheritance tax and pension tax reliefs could all be in for a shake-up as Reeves seeks to address a challenging fiscal inheritance.