Recession is certain – City

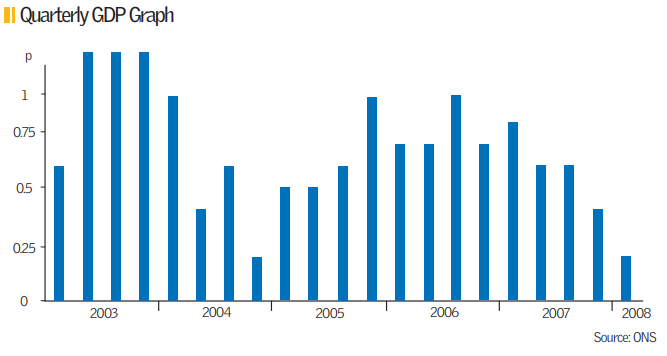

Analysts have declared a UK recession inevitable following official data showing that economic growth in the second quarter of this year slumped to its weakest rate in three years.

The Office for National Statistics revealed last week that GDP rose by just 0.2 per cent in the three months to June, bringing the annual rate down to 1.6 per cent from 2.3 per cent in the first quarter.

The ONS cited a 0.7 per cent fall in construction output – the biggest drop since the third quarter of 2005. The sector only accounts for 6 per cent of the economy, but the much bigger service sector – which constitutes 74 per cent of GDP – has also slowed dramatically in the last few quarters.

Between April and June, services sector output rose by 0.4 per cent, putting it just 2.1 per cent higher on the same period a year ago. This is the weakest annual growth since 1992, when the economy was emerging from the last recession.

“An outright recession is now our central scenario. The more up-to-date surveys suggest that in the third quarter so far, overall economic growth has ground to a complete halt,” said Paul Dales, economist at Capital Economics.

In spite of falling growth, the Bank of England’s ability to cut interest rates to boost the economy is being hampered by soaring inflation, which is running at nearly double the central bank’s 2 per cent target.

“Fiscal and monetary policy can do nothing to ease the pain. Recession seems probable.

“We look for even weaker growth and possible contraction in the third and fourth quarters,” said James Knightley, economist at Dutch bank ING.

The Bank’s one hope of easing interest rates is if there is a sustained reduction in oil and costs such as food.

Is a UK recession now inevitable?

Philip Shaw (Investec): “The pace of activity is likely to grind to a halt in the second half of the year. We have revised our GDP forecasts down again and now look for 1.4 per cent this year and 0.7 per cent next. Although this does not embody a technical recession, the economy looks as if it will be a stone’s throw away from it.”

Howard Archer (Global Insight): “We expect the economy to stagnate at best through the second half of 2008 and the early months of 2009 as consumers rein in their spending in the face of major headwinds and investment is pared back. Mild recession is now looking highly possible.”

Peter Newland (Lehman Brothers): “With service sector activity also likely to slow we expect negative GDP growth. Survey evidence points to softer service sector activity heading into the third quarter, as well as further declines in industrial output and construction.”