Randgold soars as production offsets gold dip

GOLD miner Randgold Resources topped the FTSE 100 yesterday, after a third-quarter update showed its plan to increase production and cut costs was paying off.

Production rose 19 per cent over the third quarter and production costs per ounce fell by 17 per cent.

Gold sales increased by 38 per cent from the previous quarter, largely due to the increased production.

Profits fell by 20 per cent to $97.5m (£60.8m) from $121m a year earlier, due to the drop in the average price of gold, but rose by 80 per cent quarter-on-quarter due to the increase in sales.

Earnings per share rose to $0.88 quarter-on-quarter, beating consensus forecasts of $0.67.

The Kibali project in the Democratic Republic of Congo has now started commercial production and is set to beat its 30,000 ounce production forecast for the fourth quarter of 2013.

It is on track to meet next year’s target of 550,000 ounces.

“Our focus now is on securing steady-state production at Kibali while completing the rest of the development, and on achieving the full benefit of the performance-enhancing projects at [mines] Loulo-Gounkoto and Tongon,” said chief executive Mark Bristow.

“But we’re also still maintaining a strong emphasis on exploration.”

The firm has a 2013 annual production forecast of 900,000 to 950,000 ounces and cash cost guidance of around $700 to $750 per ounce, which Bristow said it was on track to meet.

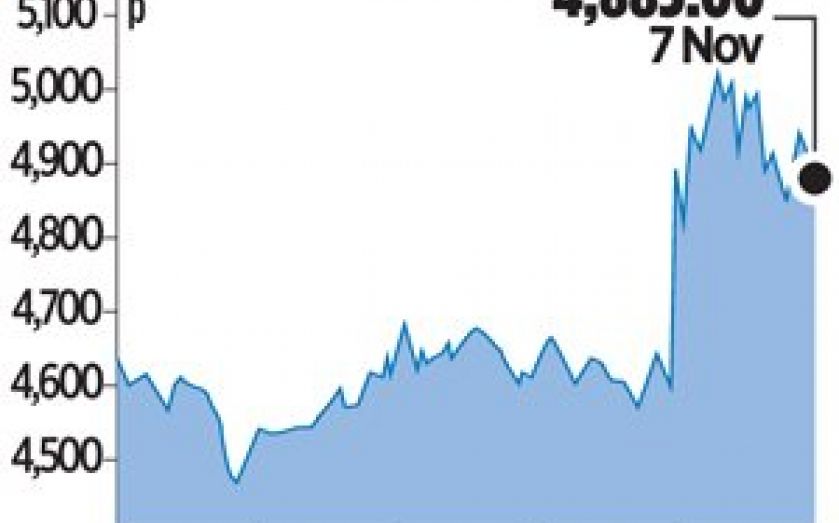

Analysts at Nomura said: “Excellent quarter from Randgold. Cost control appears to have been strong in the quarter.” Shares yesterday closed up 6.1 per cent at 4,885p.