Positive surprise as protectionism fears not bearing out

Despite Trump election and Brexit, free trade appears to be growing stronger

Investors who worried that recent protectionist sentiment would slow free trade can breathe easier. Over the last 18+ months, Brexit, Donald Trump’s election, nationalist sentiment in Europe and other developments sparked investor fear of protectionism and trade wars. Yet free trade remains alive and well, with few moves from rhetoric to actual policy. The fear doesn’t match the facts, and we believe a massive influx of new trade barriers remains unlikely to end the bull market.

Whilst protectionist sentiment could eventually translate into protectionist policy, we see the situation now as far more benign than many predicted. In some ways, the UK vote on Brexit called into question the UK-EU trading relationship, and both Trump and Democratic candidate Bernie Sanders spent much of their campaigns railing against free trade. Trump, for instance, claimed he would exit the Trans-Pacific Partnership (TPP), renegotiate or exit the North American Free Trade Agreement (NAFTA), and declare China a currency manipulator—perhaps the first step on the way to tariffs.

Whilst Brexit had many social elements and wasn’t just about economics, it did lead to worries that negotiators would weigh social concerns like the European Court of Justice’s reach and immigration control against trade. Outside the UK, growing nationalist sentiment in Europe and its possible impact on potential mergers caused some jitters, as well.

Reality, however, doesn’t always match sentiment, and it’s important for investors to track actual facts on the ground. If they do, they’ll see political leaders haven’t taken many concrete steps to slow the free flow of trade or block the global supply chain. We’re optimistic it won’t happen anytime soon.

Trump’s tariffs

Trump campaigned on a protectionist platform, but he hasn’t done much to actually advance one. He didn’t name China a currency manipulator or pull out of NAFTA. He did direct the Commerce Department to investigate barriers against non-US steel, which is potentially a precursor to new tariffs, but every US president for the past 50 years has slapped tariffs on imported steel, so Trump isn’t breaking any new ground here.

The barriers Trump did institute—on softwood lumber imports from Canada—were smaller than anticipated and part of a long dispute that predates Trump’s political career by decades. Canadian producers’ stock prices rallied on news of Trump’s tariffs, as big a sign as any that the industry didn’t take them too seriously. Although Trump removed the US from TPP, the deal hadn’t gone into effect yet and was never guaranteed to, considering other countries face difficulty ratifying it. Trump wants to renegotiate NAFTA, but his plan calls for deepening trade ties by modernizing the deal to include e-commerce. If you want to stop globalization, this wouldn’t appear to get you there.

Brexit’s impact on trade

Brexit hasn’t had much impact on trade, either, and Prime Minister Theresa May seems to consider signing new trade deals a high priority. Although May originally seemed unenthusiastic about a lengthy post-Brexit transition deal that would temporarily keep Britain in the EU’s single market, that position appears to be softening. She has also said her objective in UK-EU trade talks is to establish a broad free-trade agreement. Whilst time will tell, neither side appears keen to jack up trade barriers.

Brexit could even enhance global trade, something few would have believed a year ago. That’s because post-Brexit, the UK will be free to negotiate bilateral deals with other nations around the world. May could enter into deals with the EU and elsewhere. The US and Australia have already shown interest.

Whilst the UK focuses on Brexit, the EU continues to promote free trade. In February, the European Parliament approved the Comprehensive Economic and Trade Agreement (CETA)—a free-trade deal with Canada estimated to slash tariffs on 98 percent of goods. National parliaments still need to approve the deal, but preliminary implementation is beginning. In July, the EU announced an agreement in principle on a free-trade deal with Japan, the crowning result of four years of talks. Whilst this is a long way from completion—with parliamentary approval needed on both sides—it is a step toward freer trade between two major regions. If enacted, the deal is estimated to reduce tariffs on 99 per cent of bilateral goods traded.

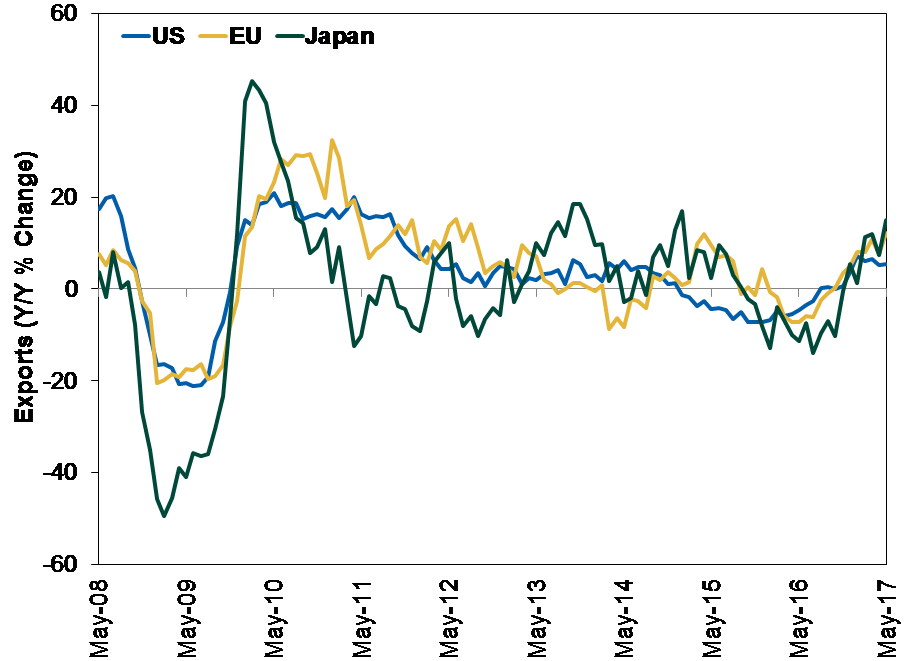

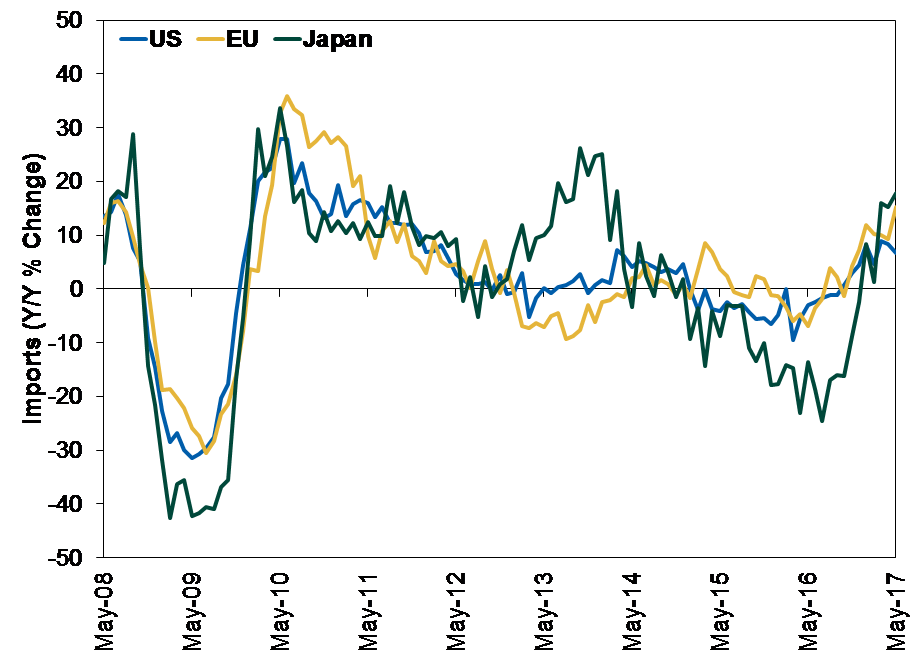

Data also argue against any setback in free trade. After contracting for most of 2015 and 2016, US, EU and Japanese exports and imports rebounded and are now growing quite strongly. Exhibits 1 and 2 illustrate this. Similarly, exports and imports for Taiwan, China and Korea bounced back.

Exhibit 1: Exports – US, EU, and Japan

Source: FactSet, as of 21/7/2017. May 2008 – May 2017.

Exhibit 2: Imports—US, EU, and Japan

Source: FactSet, as of 21/7/2017. May 2008 – May 2017.

From our perspective, these data prove current fears of protectionism simply don’t match the facts. Additionally, as world trade rebounds, it could come to the aid of economic and profit growth globally. Many investors don’t yet realize this, but as they come back and focus on reality instead of rhetoric, we believe they’ll get over their protectionism fears, gain confidence, and bid up stocks.

Investing in equity markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world equity markets and international currency exchange rates.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited Headquarters: 2nd Floor, 6-10 Whitfield Street, London, W1T 2RE, United Kingdom. Fisher Investments Europe Limited’s parent company, Fisher Asset Management, LLC, trading under the name Fisher Investments, is established in the USA and regulated by the US Securities and Exchange Commission. Investment management services are provided by Fisher Investments.

This document constitutes the general views of Fisher Investments UK and Fisher Investments, and should not be regarded as personalised investment or tax advice or as a representation of their performance or that of their clients. No assurances are made that they will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts may be, as accurate as any contained herein.