Planes, trains and automobiles – how is Europe’s transport sector curbing its emissions?

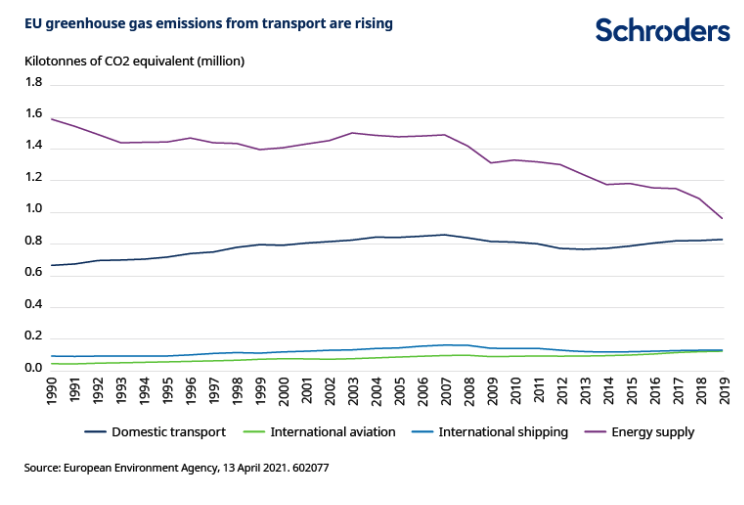

Greenhouse gas emissions in the EU fell by 3.8% in 2019, according to the European Environment Agency, bringing them to 24.0% below the levels seen in 1990.

However, the EU is targeting a 55% reduction by 2030 (compared to 1990) with the aim of reaching net zero by 2050. There is still a long way to go.

The progress made by some sectors is encouraging. Greenhouse gas emissions from energy supply are falling rapidly, for example. However, the emissions from transport are still rising, as the chart below shows.

Clearly, the transport sector is going to have to make some big changes in a short space of time. The corporate sector has a crucial role to play in coming up with products and innovations that can help meet the 2050 targets.

The difficulty is that each type of transportation – road, rail, aviation, shipping – requires a different strategy to curb emissions. Some of these areas are far more advanced in doing so than others, but the need to decarbonise is growing ever more pressing as climate deadlines approach.

As investors, we think there are returns to be made in this upcoming period of rapid change, taking advantage of any mispricing where the broader market may fail to realise the scale of the opportunity ahead.

EVs to help decarbonise road transport

Road travel makes up c.70% of Europe’s total greenhouse gas emissions from transport (source: EEA). However, the technology is available to help bring those emissions down.

Electric vehicles (EVs) are at the forefront of the drive to decarbonise Europe’s road transport and several of the continent’s carmakers are transforming themselves into EV leaders.

Volkswagen is already one of the most advanced and has set ambitious targets, including at least 70% of unit sales in Europe by 2030 to be all-electric vehicles. That implies more than one million vehicles. Another example is Stellantis, formed by the merger of Peugeot with FiatChrysler. Stellantis is targeting 70% of passenger car sales in Europe to be low emission vehicles by 2030.

There are other fuel options available. Finnish company Neste is the world’s leading producer of renewable diesel, which can reduce emissions by up to 90% compared to conventional diesel.

Another option – particularly for heavier vehicles like trucks and buses where batteries are not practical – is hydrogen fuel cells. Most hydrogen is currently produced from natural gas, which is highly polluting, but if renewable energy is used then hydrogen can essentially be made CO2-free. When used in a fuel cell, the only by-product is water.

Johnson Matthey, a company best known for producing catalysts which clean up harmful emissions, is also branching out into hydrogen. The group makes membranes which are a core component in fuel cells.

However, EVs, fuel cells and renewable diesel are not a complete solution for sustainable transport. They solve the emissions problem but there’s still air pollution caused by tyre and brake dust, plus the fact of congestion on Europe’s busy road network.

Rail on track for sustainable future

Rail has the lowest carbon footprint out of all major means of transport – it has only an eighth of the carbon footprint of air travel and a third that of road. 2021 has been declared the “European Year of Rail”, an initiative designed to promote the sector and support the EU’s climate objectives.

Rail may already be a very sustainable transport choice, but there is still scope for improvement. Train technology is becoming far cleaner and more efficient. In addition, given the focus on sustainability, government policy is increasingly being designed to encourage passengers and freight onto rail rather than roads. A case in point is France’s ban on domestic flights, in instances when an alternative journey can be made by rail in two and a half hours or less.

This means there’s an opportunity for companies offering sustainable solutions. There’s still plenty of scope for electrification, with only 54% of Europe’s rail network electrified (according to Statista data for 2018).

And the expected growth in volumes means there are opportunities for innovation too. One example is Alstom, a developer of hydrogen-powered trains which release only water as exhaust. They are already operating in Germany and other countries. Alstom’s Coradia iLint, the world’s first hydrogen powered train, can run for 600 miles on a single tank.

We see opportunities for investors as demand for rail travel grows, new trains are ordered and existing fleets modernised. However, from an emissions point of view, the trickier sectors of aviation and shipping need to be addressed.

Discover more at Schroder insights or click the links below:

– Why capex is key to solving the supply chain issues hampering the economy

– What makes a company a climate leader?

– Why investors should care about cybersecurity

Aviation demand offsets efficiency gains

Better fuel efficiency has helped curb aviation emissions in recent years; the amount of fuel burned per passenger dropped 24% between 2005 and 2017 (source: European Commission). However, this has been offset by growth in air traffic. The Covid-19 pandemic may have temporarily disrupted that growth but the sector still needs to cut its emissions dramatically.

Alternative fuels are a potential answer. In addition to renewable diesel for cars, Neste has turned its attention to planes with the development of a sustainable aviation fuel (SAF). This is produced from used cooking oil, as well as animal and fish fat waste from the food processing industry.

The resultant fuel reduces GHG emissions by up to 80% compared to conventional jet fuel. The product is used by Lufthansa and KLM, blended with fossil jet fuel, on flights departing from Frankfurt and Schiphol airports.

It’s an area of exciting innovation and growth which could be helped by more ambitious regulation. In July, the European Commission released its RefuelEU Aviation proposals which would mandate a minimum share of 5% SAF in 2030, rising to 63% in 2050.

A crucial point is that SAF should not be made with food crop-based biofuels, as this risks displacing land needed for food production. Neste and other producers will have an important role to play in further developing and producing SAF at scale.

The Commission has also proposed ending the exemption of aviation fuel kerosene from energy taxation, as well as ending free GHG emission allowances for aviation within the EU by 2026.

The push for green shipping

The sight of the Evergreen container ship stuck in the Suez canal earlier this year – and the knock-on disruption – made clear just how much the world relies on shipping for freight. However, that comes at the cost of harmful emissions.

As with aviation, the European Commission’s latest proposals aim to end the tax exemption for heavy fuel used by the maritime industry. At the same time there will be a zero rate of taxation on sustainable fuels to encourage uptake and the Emissions Trading Scheme will be expanded to include the sector.

This comes on top of existing global regulations designed to limit sulphur content in shipping fuels. However, recent studies suggest that very low sulphur fuel oil (VLSFO) may actually cause higher emissions of the pollutant black carbon, as well as sub-optimal engine performance compared to high sulphur fuel oil (HSFO).

In the short term, this could see the industry switch back to HSFO and use “scrubbers” to clean up emissions. However, it also increases the pressure to find an alternative fuel source. Batteries are one potential option but are only suitable for smaller vessels on short journeys.

Liquified natural gas (LNG) could be the medium-term winner as it emits less carbon dioxide, sulphur dioxide or black carbon than HSFO. But that’s not a long-term solution either as LNG produces significant amounts of methane.

Longer term, green hydrogen and ammonia are promising zero carbon solutions. Hydrogen has enough energy density to be used on large ships and long journeys, while combining hydrogen with nitrogen produces ammonia which is easier to store. Again though, both hydrogen and ammonia would need to be produced sustainably and this is an area where significant investment is needed.

What does this mean for investors?

As we can see, different transport sectors are at very different stages of their transition to a low emissions future.

For both road and rail, the necessary technology is already available. The question is one of take-up and, for investors, backing the winning companies who are best placed to take advantage of the growing demand.

For aviation and shipping, the technologies needed for decarbonation are still relatively nascent. The case of VLSFO highlights the need for companies and regulators to tread carefully and ensure that solving one type of emissions problem doesn’t simply create another.

In our view, this creates an enormous opportunity for investors who can identify innovative companies capable of developing technology and products that can make the transition reality.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.