Ophir confirms plans to sell off Tanzanian asset

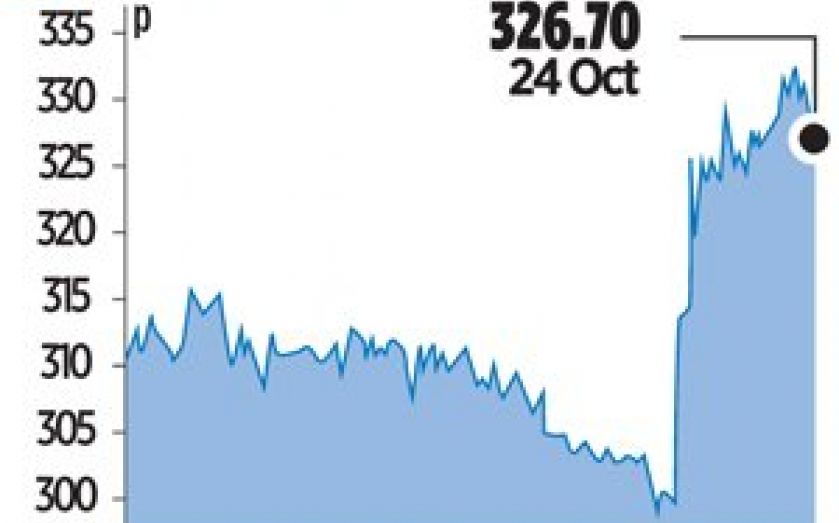

AFRICA-FOCUSED oil explorer Ophir Energy soared to the top of the FTSE 250 yesterday, after the firm confirmed that it is looking to sell part of its Tanzanian assets.

“We’re not surprised by the sale, due to the extent of the Tanzania project in terms of capital,” Kate Sloan, analyst at Liberum Capital, told City A.M. “We assume it will cost around $25bn (£15.5bn), which is too big for a company of this size to undertake alone.”

Sloan added that interest in the Tanzanian asset is likely to come from a government-funded strategic buyer, perhaps Indian or Chinese.

Ophir indicated back in March that it was looking to sell off part of its 40 per cent stake in the oil fields.

Its lack of comment on the progress of a deal at the time of its half-year results in August worried investors, prompting chief executive Nick Cooper to request patience.

“There is no certainty that this process will conclude successfully nor can there be any certainty over the value of any such deal if it were to complete,” Ophir added in yesterday’s statement.

Liberum said in a note last week: “Overall, there appear few realistic scenarios that suggest significant upside to [the company’s] current share price. Those that do, require either a low cost of capital and no capital gains tax, or the belief that a buyer will pay a material premium for exploration.”

Ophir posted losses of $19.4m in the first six months of the year, compared to $24m in the same period last year.

Shares closed 9.1 per cent higher.