Oil prices to stay high this year on China reopening and OPEC output snags, experts predict

Oil prices will be propped up this year by a combination of rebounding demand from China alongside tightening supplies into Europe amid capacity issues across OPEC and its allies.

The International Energy Agency and OPEC both unveiled bullish oil outlooks this month for 2023 – predicting demand will rise by 2m and 2.3m barrels per day respectively, with China’s economy reopening this year after U-turning from its restrictive zero-Covid approach to the pandemic.

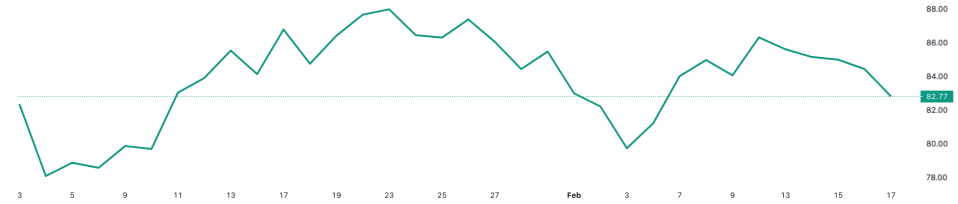

This will keep oil prices elevated, with Brent Crude prices remaining stable above $80 per barrel into the new year despite the US Federal Reserve’s interest rate hikes squeezing demand and economic volatility across developed markets.

Callum Macpherson, Investec’s head of commodities, told City A.M.: “OPEC and the IEA are becoming more optimistic on the demand outlook for 2023 as confidence increases that the reopening of China will not be hampered by renewed covid lockdowns. This is positive not just for Chinese demand, but also for neighbouring counties that are likely to experience increased air traffic with China.”

Craig Erlam, senior market analyst at Oanda, believes the effect of China’s reopening is larger this experts have calculated, with the country standing out as the “major demand factor in oil markets in 2023.”

Brent Crude has jumped to over $80 per barrel this year

He said: “Despite early scepticism, what evidence is available suggests its emerged from the first big wave in a strong position meaning the recovery over the next few quarters could be powerful. This is a big upside risk for oil prices depending on just how powerful that recovery is.”

There are growing expectations that China returning to the global economy will be amplified by weaker production – putting more pressure on global markets.

OPEC+, the extended cartel alliance including Russia, was behind in its output targets – with only US shale providing an alternative source of growth in production.

This a challenge for the oil industry, with Investec calculating that OPEC+ needs to produce around 29.9m barrels per day to maintain a balanced market this year as demand increases, which is one million barrels per day more than it currently is producing.

Macpherson said: “It is not clear if or how supply will keep up with demand. How this shortfall can be covered could be the key question for oil markets this year.”

Experts uncertain over oil sanctions effect

Another factor at play in oil market are the growing list of EU and G7 sanctions on Kremlin-backed supplies, including seaborne shipments, oil products and price caps following the country’s invasion of Ukraine.

Erlam believed sanctions were “another relative unknown,” which were highly likely to impact output – but the extent was dependent on global cooperation.

He said: “It partly depends on the price of oil and the extent to which the price cap is enforced and followed, something that until now hasn’t been a big problem as it’s been selling below those levels anyway.”

However, Macpherson was unconvinced sanctions had been as successful as hoped, with Russia offloading oil supplies to non-Western buyers such as China and India. Urals crude is trading at a 38 per cent discount to Brent crude.

He also speculated that Russia’s latest plans to cut output by 500,000 barrels per day in March “might turn out to be a cover story for Russia having genuine difficulties in maintaining output.”

“Time will tell, but if there is a downward trend in Russian output this year, it will make the already difficult task of meeting expected demand increases even more challenging, and this will tend to support prices,” he said.