Oil prices could surge above $150 per barrel if Hamas-Israel conflict escalates

Oil prices could soar to a record high of more than $150 per barrel if the war between Israel and Hamas escalates to a full-scale conflict in the Middle East, the World Bank has warned.

It warned there was a possibility the conflict could impose a “dual shock” to financial markets, following Russia’s invasion of Ukraine last year, and could lead to oil prices entering “uncharted waters.”

In its latest monthly Commodity Markets Outlook, the World Bank has assessed the potential economic risks of the war extending beyond Gaza and Israel’s borders.

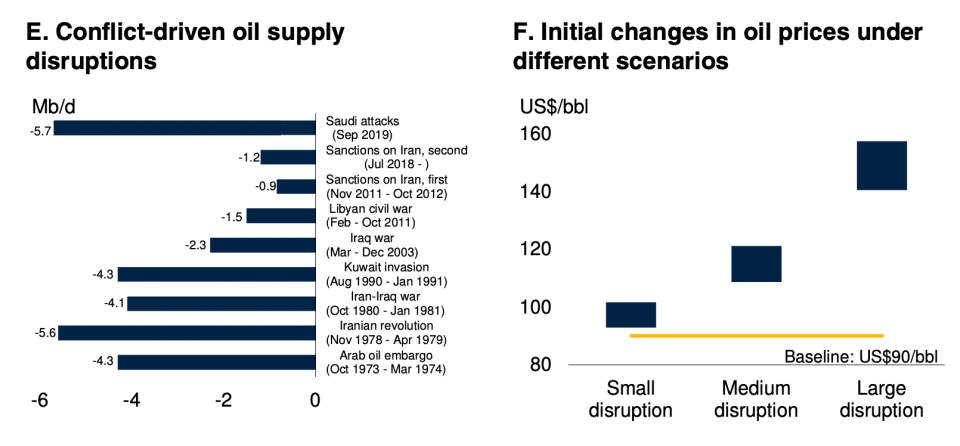

The financial institute predicts that a “large disruption” scenario similar to the 1973 oil embargo, when members of the Organization of Arab Petroleum Exporting Countries boycotted Western markets, could lead to oil prices spiking from $90 per barrel to highs of $140-$157 per barrel.

The previous record was $147 per barrel barrel in 2008 during the previous economic downturn triggered by the financial crisis.

“Policymakers will need to be vigilant. If the conflict were to escalate, the global economy would face a dual energy shock for the first time in decades – not just from the war in Ukraine but also from the Middle East,” the World Bank warned.

The region accounts for a third of global oil production, with prices rising three per cent at close of play on Friday.

However, Israel’s ground invasion of the Gaza strip has not triggered a further spike in prices in today’s trading, despite fears over retaliatory action from neighbouring countries and potential sanctions over supplies coming into the region.

Both major benchmarks have dipped in this morning’s trading, with investors waiting to see whether the US Federal Reserve hikes rates again and if the latest manufacturing data from China indicates a potential revival in demand.

Brent Crude has dropped 1.48 per cent to $89.14 per barrel in the early sessions, while WTI Crude has slipped 1.75 per cent to $84.04 per barrel – with both major benchmarks weighed down ahead of key indicators later in the week.

The Fed is set to meet on Wednesday, and is expected to keep interest rates unchanged at a 22-year high of 5.5 per cent to 5.75 per cent.

The Bank of England will meet the following day, with domestic rates set at 5.25 per cent amid sustained inflationary pressure.

Hawkish action from central banks to tame inflation has put downward pressure on oil prices, with expectations of reduced demand amid the looming threat of a global recession.

China is also expected to unveil its purchasing managers index data for manufacturing and services this week, with hopes the country’s hoped economic revival will power oil demand.

The country has recovered sluggishly from heavy pandemic restrictions but there are hopes the economy could stabilise amid stimulus from China’s government.

This follows oil prices rallying last month following OPEC’s swingeing supply cuts, totalling over five per cent of global supplies,