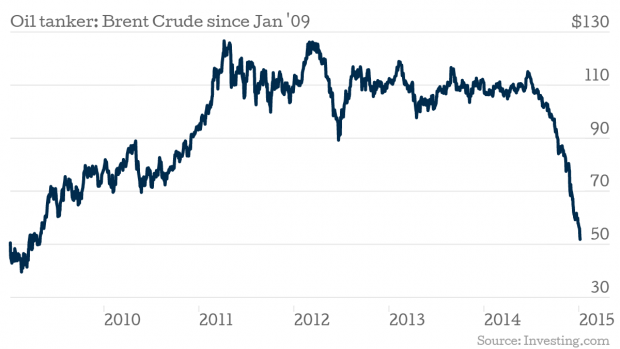

Oil prices are falling again as Brent crude edges closer to $50 a barrel

Brent crude is flirting with the $51 a barrel mark, falling again on Tuesday after yesterday’s carnage. Considered an international benchmark, it fell $1.42 to $51.64 in early trading, despite data showing 17 US oil rigs stopped operating in the week leading to 2 January.

The fall takes the number of rigs to 1,482 which, according to statistics seen by the Financial Times, is the lowest level since March last year, which should weaken supply.

Today's slide comes after heavy declines yesterday, when Brent fell by $3 yesterday to prices lower than at any time since 2009.

Oil prices having been dropping since a worldwide supply boom, with Brent crude losing almost 50 per cent of its value since June. OPEC, the cartel of oil producing nations, has insisted it won’t lower its prices as it attempts to counter the rise of the US shale industry. The cartel seems set on maintaining its market share, rather than chasing short-term profits. Saudi Arabia wooed European clients on Monday by lowering its prices.

Yesterday WTI crude fell below $50 a barrel, prompted partially by data which showed Russian oil output had reached its highest since the Soviet era, while exports of Iraqi oil neared a 35-year high.

Analyst Malcolm Graham-Wood said that despite the continuing fall, a cap on production remains unlikely.

So, no respite yet and no sign of the ‘C’ word, as with the bulls already carried out the oft awaited capitulation hasn’t quite happened yet I feel. We are however getting closer to one or two longer term support levels so if you are looking for a straw to cling on to you need WTI to defend $45…