Mutuality stages a comeback as Co-op buys Somerfield for £1.56bn

Three months ago Co-operative Group chief executive Peter Marks unveiled a bold three-year plan to double the group’s profits.

The fortunes of the mutual store group were flagging, with 2007 profits down almost 50 per cent and the group offering little competition to the main supermarket chains.

Yesterday, the first phase of Marks’ plan to reverse the slow relative decline of the organisation which was Britain’s biggest food seller in the 1960s was finally unveiled.

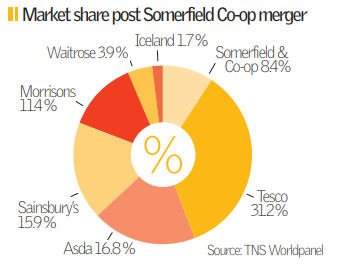

The £1.56bn acquisition of Somerfield catapults the Co-op up the rankings to become the UK’s fifth biggest supermarket – behind Tesco, Asda, J Sainsbury and WM Morrison – with a market share of 8 per cent and 3,000 stores.

The deal will see the Co-op acquire 880 Somerfield stores, although it is likely the group will have to sell around 120 stores to address local competition concerns. The Somerfield brand will disappear. Somerfield notched up net sales of £4.2bn last year, earning £233m before interest, tax, and depreciation.

Somerfield’s owners, a consortium including private equity firm Apax, Barclays Capital and property millionaire Robert Tchenguiz, who together bought the chain for about £1.1bn in 2005, put the group up for sale in January. Despite the sale price being considerably below their target of £2.5bn, the deal will still provide a solid return for the consortium.