Morrisons to launch cost cutting drive

Sir Ken Morrison revealed yesterday that he had no plans to quit the retail business his father founded and planned to lead the enlarged supermarket into the post-Safeway era.

“My present intention is to stay around for another two to three years,” he said The conversion of former Safeway stores into Morrisons outlets will be complete by the end of November and Sir Ken believes it will “take a little bit of time to get everyone match fit.” The search for CEO Bob Stott’s successor is underway, with internal and external candidates already in the frame.

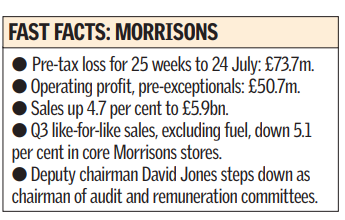

The supermarket chain bought rival Safeway last year and will now embark on an “optimisation” programme to trim business costs back. The cost cutting drive will be led by new group finance director Richard Pennycook and involves many job losses. The retailer is consolidating in smaller headquarters and three former Safeway depots are set to close. The combined IT and finance department alone will be reduced from 800 to 600.

The optimisation programme will set out a plan for growth, but the details will not be revealed until March.

Shares rose just over 2 per cent to settle at 170.5p as the market breathed out in the absence of a fresh profit warning and industry data showing it had recouped some market share.

The retailer has been focused on Safeway and the core chain has suffered, with like-for-like sales, excluding fuel, down 5.1 per cent in the third quarter. Converted stores delivered strong, albeit slowing, sales increases, up 11 per cent like-for-like, excluding fuel, in the 12 weeks to 16 October.

Comparisons are complicated by store disposals but Pennycook insisted the figures included £250m of “genuine sales growth. “We will see positive like for-like sales in the core Morrisons stores in early 2006,” he added.

The retailer is also holding on to former Safeway customers. Its AB customer spend profile is 18 per cent, close to the industry average of 19 per cent.