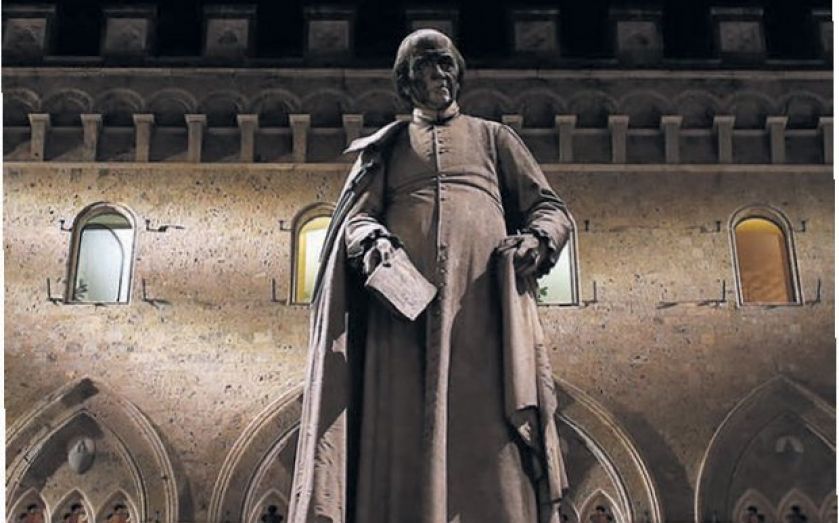

Monte dei Paschi reveals massive rights offering

THE BOARD of Italian bank Monte dei Paschi di Siena approved a colossal €3bn (£2.51bn) rights issue yesterday, seeking to save itself from nationalisation.

At the beginning of this month, the European Commission received the bank’s restructuring plan, which has still not been approved. In February this year, Monte dei Paschi received a bailout from the Italian state to the tune of €4.1bn in an attempt to cover massive losses from derivatives trading.

Shares in Monte dei Paschi, which is Italy’s oldest existing bank, dropped significantly as markets opened, settling at €0.184, 5.93 per cent down.

If the bank does not raise enough capital, it could be taken over by the Italian government.

EU’s competition commissioner Joaquin Almunia suggested earlier this year that if the struggling bank could not raise its own capital, Italy’s government would have to act, converting the loans it has made into equity and taking a direct stake.

The size of the issue revealed yesterday has tripled from some estimates as recently as this summer, when an offering of €1bn seemed more realistic. As of yesterday, the bank’s market capitalisation was around €2.1bn.

Last month, research from Societe Generale suggested that the decisions made around the bank’s bailout could have wider implications for the financial institutions across the currency union: “Monte dei Paschi is being given considerable time to repay recently received state aid. This decision took place after the Commission decreed bail-in to be a precondition to state aid approval.

“We are uncertain as to the rationale for this, but note that the commission cannot require a country to do something that is illegal. In the absence of a bank resolution and recovery directive, bail-in may not only be seen as illegal, but inequitable across various jurisdictions.”