Manufacturing slide continues in wake of market uncertainty

The slide in UK manufacturing continued in September, with production declining for the seventh successive month.

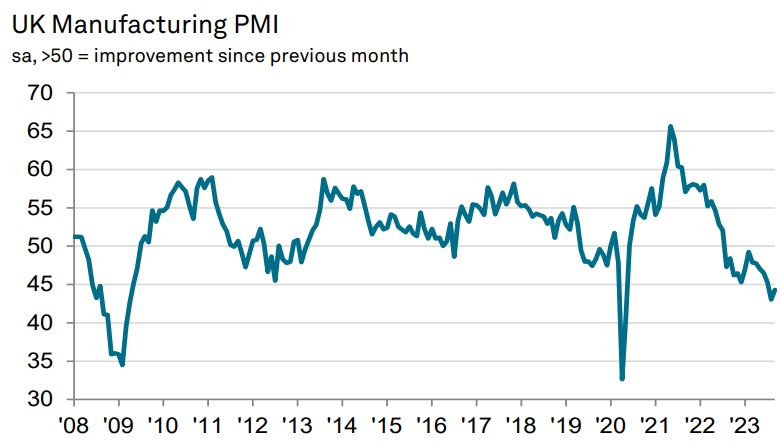

According to the Chartered Institute of Procurement & Supply (CIPS) the UK manufacturing purchasing managers index (PMI) recorded 44.3 in September, revised up slightly from the initial estimate of 44.2. The 50 mark separates growth from contraction.

Although September’s reading was stronger than the 43.0 recorded in August, it was still among the weakest readings seen in the past 14 years.

“Demand was impacted negatively by ongoing market uncertainty, the cost-of-living crisis and weak conditions in overseas markets,” the report said.

Rob Dobson, director at S&P Global Market Intelligence, said: “September saw the manufacturing sector still mired in contraction territory, as weak conditions at home and abroad hit new order intakes and led to a further scaling back of production volumes.

“The cost-of-living crisis and recent rapid rise in interest rates are taking their toll, according to producers, raising the possibility of the broader UK economy slipping back into contraction during the second half of the year,” Dobson said.

Intermediate goods — items used to produce other goods for sale — remained the weakest performing category.

The survey showed that new export business contracted for the 20th successive month, although the rate of decrease was “noticeably slower” than the previous month.

On the back of weakness in the sector, employment in manufacturing fell for the twelfth consecutive month with job losses falling at the second-steepest rate in the period.

Falling demand meant that input costs continued to fall in September with prices falling across a range of inputs. However, selling prices crept up for the first time in four months.

Manufacturing in almost all major economies has been contracting for many months now. Slow growth in China has dented demand while consumers have increasingly prioritised spending on services rather than goods post-pandemic.

However, looking forward Martin Beck, chief economic advisor to the EY Item Club, said “manufacturers still enjoy some positives, including an easing in input cost inflation, healing supply chains and, in some parts of the sector, new government support.”