London Report: Glimmer of light for pharma deal brightens FTSE

BRITAIN’S top share index edged up yesterday as shares in drug-maker Astrazeneca rebounded on the view that what appeared to have been an unsuccessful £69bn bid for the company may still have a chance of going through.

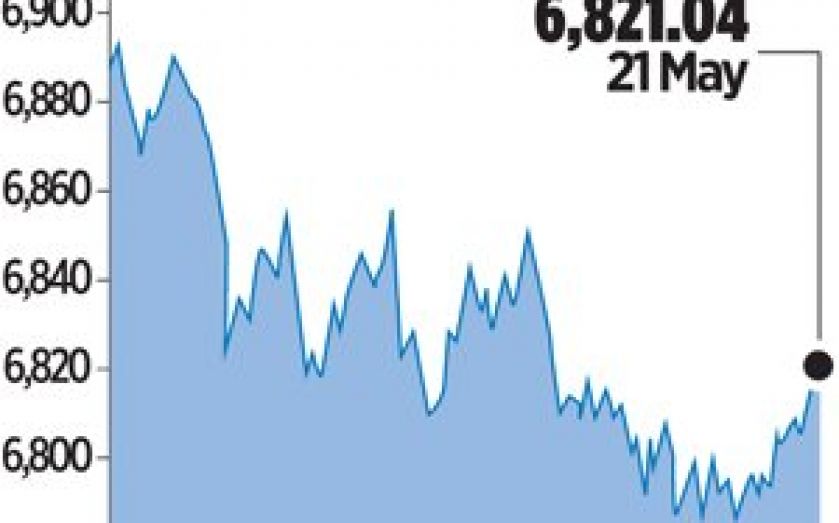

Pharma giant Astrazeneca rose 2.6 per cent, adding the most points to the blue-chip FTSE 100 index, which closed up 19.04 points or 0.3 per cent at 6,821.04 points.

Shares in the UK company had tumbled 11 per cent on Monday of this week after it rejected a bid offer from US rival Pfizer. But several of Astrazeneca’s top institutional investors such as Axa Investment Managers have urged it to let Pfizer put its offer to its shareholders.

Beaufort Securities sales trader Basil Petrides said such calls from shareholders to consider Pfizer’s bid were helping Astrazeneca’s shares recover some ground.

“There’s a small bounce on hopes that Pfizer might go hostile, but I wouldn’t want to trade Astra right now. It’s too risky to bet on Pfizer going hostile,” he said.

Struggling supermarket chain WM Morrison was the worst-performing FTSE 100 stock in percentage terms, falling 2.2 per cent after Deutsche Bank analysts cut their rating on the company to sell from hold, mainly on valuation grounds.

Last week the FTSE climbed to 6,894.88 points, which was its highest level since December 1999, but it has since lost ground.

Traders said the fact that the FTSE had failed to break above 6,900 points had induced some investors to go short and sell out to book profits on last week’s run-up.

“We’re in a bit of a no-man’s land at the moment. We’ve lost a little bit of froth but we’re not getting a lot of momentum either way,” said MB Capital trading director Marcus Bullus. “I’d be more inclined to short at the moment and book profits,” he added.

Meanwhile in southern Europe, bond prices recovered after drops in recent days.

Italian 10-year yields, which move inversely to bond prices, were down six basis points last night, easing to 3.2 per cent.

The peripheral Eurozone debt came back into vogue as the appeal of high returns outweighed nervousness around potentially destabilising European Union elections this week.

For Portugal, the yield on equivalent 10-year notes was down 14 basis points to 3.83 per cent.