London Report: FTSE suffers its sharpest daily fall in a month

BRITAIN’S top equity index had its biggest one-day decline in a month yesterday, retreating from a three-week high as a drop by housebuilders weighed on the market.

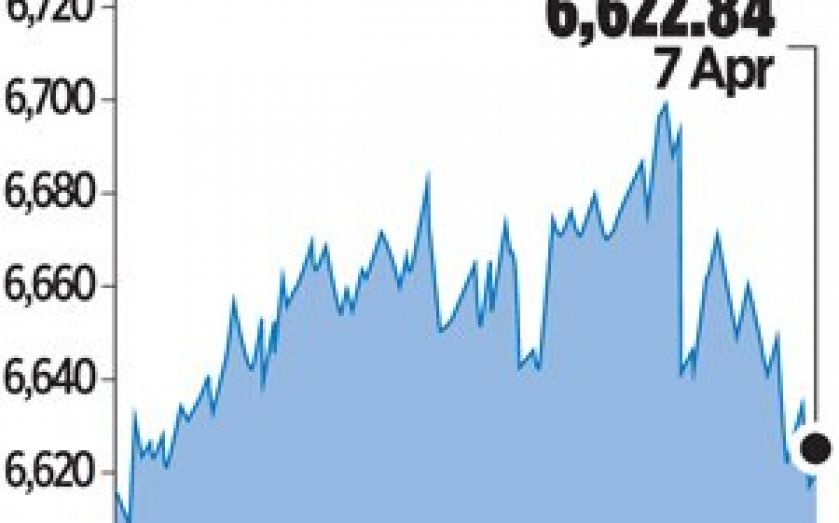

The blue-chip FTSE 100 index, which rose 0.7 per cent on Friday to reach its highest point in around three weeks, closed down by 1.1 per cent, or 72.71 points, at 6,622.84 points.

That was the FTSE’s biggest one-day drop since a similar 1.1 per cent decline at the close on 7 March.

Housebuilding and property stocks slumped, even though the FTSE 350 construction and building materials index rose 23 per cent last year and is up around 12 per cent this year.

Traders said the sector was weighed down by reports from the HomeOwners Alliance yesterday and a Sunday newspaper that rising property prices could form a bubble and make homes unaffordable.

“The property and housebuilding stocks are taking a hit on the back of these negative comments about the outlook for the sector,” said Central Markets trading analyst Joe Neighbour.

Housebuilder Barratt Developments fell five per cent, making it the worst-performing FTSE 100 stock in percentage terms, while rival Persimmon also slipped four per cent.

Concern that corporate earnings were not strong enough to justify the ratings of companies on the FTSE 100 also hurt stocks.

The FTSE 100 is trading on a 12-month forward price/earnings ratio of 13.2 times, compared with a five-year average of 11 times, according to Thomson Reuters Datastream.

“There are question marks about valuations,” said Brown Shipley fund manager John Smith. “This year, stocks have to deliver earnings growth to justify the rating.”

The FTSE 100 rose 14.4 per cent in 2013 to post its best annual gain since 2009, and it reached a peak of 6,867 points in January this year, near its best level since early 2000.

It has since slipped back, amid a slump in emerging markets and tensions between Russia and Western powers over Ukraine, and Smith expected the market to remain trapped in that range in the near-term.

“There is not enough belief at this point in time to push the market higher,” he said.

Stocks were also hit elsewhere in Europe. France’s Cac index lost 1.08 per cent, while Germany’s Dax was down 1.91 per cent. The Euro Stoxx 50 fell 1.37 per cent.