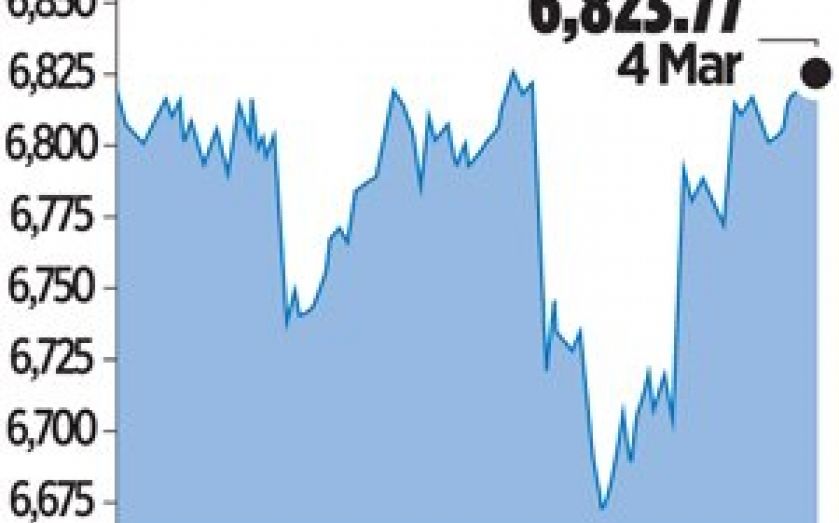

London Report: FTSE reverses losses as crisis in Crimea eases

THE UK’S top share index rebounded from two-week lows yesterday, recouping its losses in the previous session, with the perception that tensions between Russia and Ukraine were easing and robust earnings boosting investors’ risk appetite.

However, investors remained cautious in placing strong bets on the sustainability of the share rally, given that Russia and the West remained at loggerheads over Russia’s actions in Ukraine. Russian President Vladimir Putin gave orders to end an army exercise and said the use of force was a choice of “last resort”.

But he added that Russia reserved the right to intervene if there was “lawlessness” in Russian-speaking eastern Ukraine.

The blue-chip FTSE 100 index closed 1.7 per cent higher at 6,823.77 points after falling 1.5 per cent on Monday after Putin’s secured parliamentary approval to send Russian forces into Ukraine. The threat provoked a global equities sell-off on Monday, with investors shunning riskier assets such as equities.

Yet easing tensions and strong corporate earnings attracted a lot of buyers back into the market.

“Geopolitical issues aside, investors’ main focus remains on the performance of the corporate sector. There are some signs of life from this reporting season and we do see the earnings picture improving from here,” said Robert Parkes, equity strategist at HSBC Securities.

Equipment hire group Ashtead spiked 13 per cent to the top of FTSE 100 risers’ list after increasing its third-quarter profits by 51 per cent and raising its full-year profit target.

Natural resources firm Glencore Xstrata rose 1.7 per cent on forecast-beating profit.

Lex van Dam, hedge fund manager at Hampstead Capital, said he believed the market’s short-term direction would be higher because world powers had nothing to gain from a conflict over Ukraine and so the crisis was not likely to get worse.

Analysts stressed that the market swings caused by the tensions in Ukraine should be seen in the context of the recent market rally, which has seen the UK benchmark index bounce nearly six per cent off lows hit at the start of February.

That has left the FTSE 100 trading on a 12-month forward price/earnings ratio of 13.6 times, against 12.9 times at the beginning of February, data shows.