London Report: China trade data surprise breaks FTSE’s losing run

THE FTSE 100 benchmark equity index broke a four-day losing streak yesterday as forecast-beating trade data from China, the world’s biggest metals consumer, lifted mining stocks.

China’s exports and imports both rose more than expected in July, in a tentative sign of economic recovery. The basic materials sector added 12 points to Britain’s FTSE 100, led by gains in Antofagasta and Anglo American.

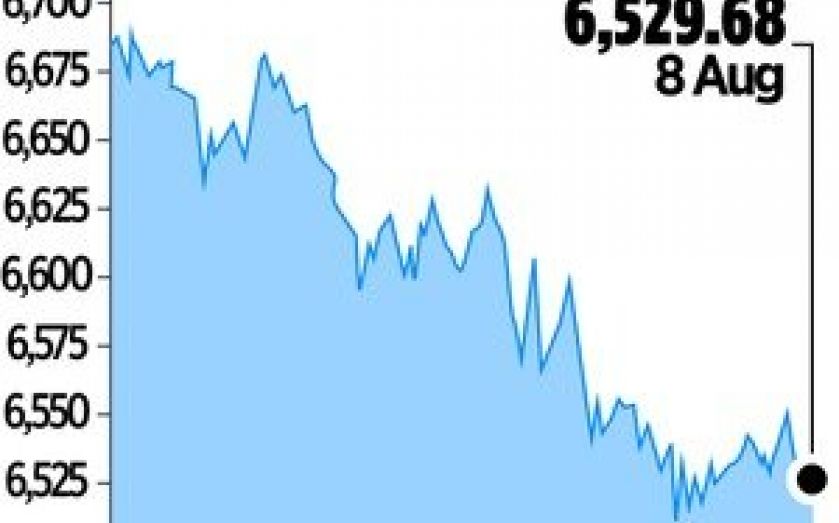

The blue-chip index, where miners are the third-biggest sector, closed up 0.3 per cent or 18.47 points at 6,529.68, recovering after a 1.4 per cent fall the previous session.

“That (Chinese data) put all the market participants on the right footing and led the sentiment on global economy towards the fact that China will not derail the recovery,” said Stephane Ekolo, chief European equity strategist at Market Securities.

“The bulls are dominating the market right now … I think the UK might outperform continental Europe because you have the housing market that is starting to do pretty well and some other companies doing well,” he added.

Aviva was the biggest riser, up 7.6 per cent. Higher first-half profits lured investors into shares in the insurer, which had lagged the market since a spring dividend cut.

“A dearth of economic data means that corporate figures have become the main focus, with insurers being the centre of attention. It appears to be a case of ‘the good, the bad and the ugly’, at least in terms of the reception given to results from (respectively) Aviva, Standard Life and Schroders. However, Aviva’s surge this morning is more a reflection of the heavy beating the shares have taken, and the Herculean turnaround programme has a long way to run yet. Regardless of performance, all three shares offer dividends well in excess of the Bank of England’s unchanging base rate, so we can rest assured that the yield hunt is not finished yet,” said IG market analyst Chris Beauchamp.

Overall the results season has been mixed with about 44 per cent of the FTSE 100 companies who have reported second-quarter earnings missing forecasts, according to StarMine.

On the downside, fund manager Schroders slipped 5.3 per cent after bigger-than-expected outflows in June prompted profit-taking on a stock that set record highs earlier this week and is up 40 per cent since the start of 2013.

Not everyone was convinced by the FTSE 100’s ability to sustain the rebound, especially after Wednesday’s monetary guidance from the Bank of England raised the possibility that interest rates could rise sooner than previously expected.

Steve O’Hare, analyst at First 4 Trading, recommended selling the index in front of 6,550, with a stop at 6,580 and the first downside target at 6,485.