London house prices fall but still almost double national average according to Halifax property index

London house prices have fallen by almost one per cent from January, but property in the capital still costs £240,000 more than the national average.

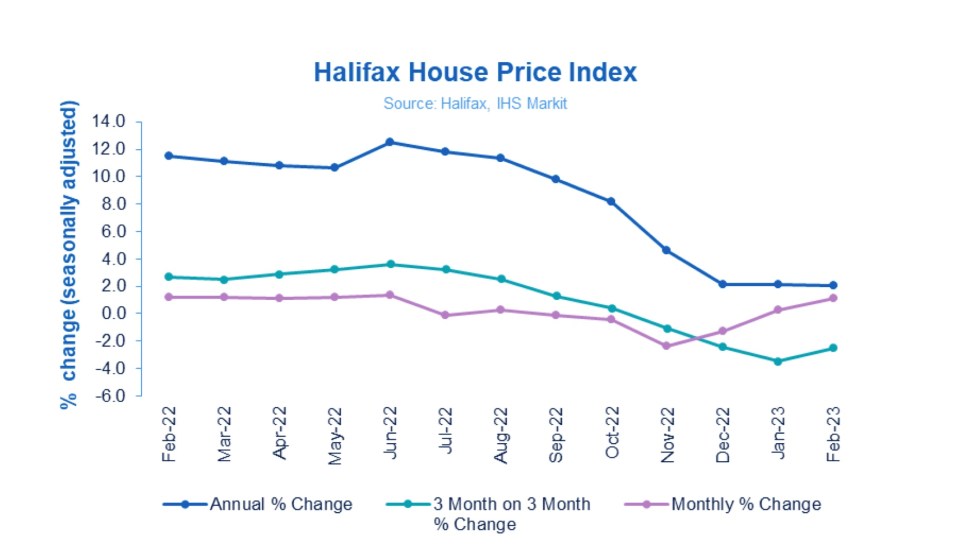

Halifax’s latest house price index for February showed the rate of annual national growth slowed across the UK, with the average property now sitting at £285,476.

In the capital however, property prices took a slight hit last month, down to £526,842, a 0.9 per cent fall from January’s £530,416.

This comes after homeowners and prospective property buyers received a major setback last year during the disastrous mini budget, raising mortgage rates.

Interest rates are currently at four per cent as the Bank of England have warned it may need to raise it further to offset inflationary pressures.

The index shows that London’s property dip was caused probably by its reliance on flats, which have seen a stagnation in prices.

However, the average London home is still costing almost double the average.

When broken down by property type, flats are now into negative territory over the last year, at -0.3 per cent annual growth, while terraced properties have stagnated.

Detached properties are up +1.5 per cent on last year, which is the lowest rise since pre-pandemic.

The HPI added that price inflation is stronger for new houses than existing ones, at 6.6 per cent, which is a four month high.

Across the country the rate of growth remained slow, staying at +2.1% for third month in a row. This Monthly change 1.1 per cent from 0.2 per cent in January and -1.3 per cent in December.

While London and the south is considerably more expensive, annual growth reduced most in the North East, at 1.1 per cent in February vs a rise of 3.6 per cent in January, with homes now costing an average of just £163,953.

“The average house price in February was £285,476, 2.1 per cent up on this time last year, and has been stable over the last three months”, said Kim Kinnaird, Director, Halifax Mortgages.

“When comparing to January, there was a 1.1 per cent increase in house prices through the month of February, although overall prices are flat compared to three months ago.

“Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices following the falls seen in November and December”, in wake of the mini-budget.

“Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.

“In cash terms, house prices are down around £8,500 (-2.9 per cent) on the August 2022 peak but remain almost £9,000 above the average prices seen at the start of 2022 and are still above pre-pandemic levels, meaning most sellers will retain price gains made during the pandemic.

“With average house prices remaining high housing affordability will continue to feel challenging for many buyers.”

According to HMRC, the number of monthly property transaction sales decreased in January from 99,260 in December to 96,65.

The Bank of England’s latest figures sow mortgages approved to finance house-buying also decreased in January by 2.2 per cent, to 39,637 per cent.

Capital’s “chronic” undersupply

Following this morning’s latest Halifax HPI figures, industry experts have weighted in to reflect on what the dip in house prices means for prospective buyers.

Chief Executive of Propertymark, Nathan Emerson, warned that “increases to interest rates have caused buyers to rethink their budget and haggle on price, but the drive evidently still remains to see their purchase through and move home.”

Meanwhile, Matthew Thompson, Head of Sales at Chestertons, said that “as the UK economy has shown signs of recovery, we are beginning to see more sellers wanting to capitalise on the positive market sentiment.

“In February, our branches registered a two per cent increase in the number of properties being put up for sale compared to the same month last year.”

“Still, the capital continues to experience a chronic undersupply of suitable housing; particularly as demand has remained strong since the start of 2023 with more buyers booking in viewings.

“Simultaneously, the number of offers being withdrawn has decreased by 11 per cent which indicates that there are fewer window shoppers and more serious buyers entering the market.”

Chief executive of mortgage broker SPF Private Clients, Mark Harris, looked ahead to the next Bank of England rate decision on 23 March, saying: “Lenders continue to jockey for position with a number increasing the pricing of their cheapest five-year fixes.

“However, even if there is another base rate rise this month, there is a growing expectation that rates are close to their peak, and if inflation also continues to fall, the outlook appears brighter for borrowers.’

Iain McKenzie, CEO of The Guild of Property Professionals, also said that: “House prices continue to defy the gloomy forecasts that we were seeing a few months ago and are remaining buoyant for the time being.

“In fact, February even saw a slight increase compared to last month, while annual prices show a cooling effect in the market.

“While some buyers may be hoping for a more dramatic readjustment in house prices, it means that you won’t find yourself in a position where the value of your property falls as soon as you sign on the dotted line.”