Klarna rolls out physical card for UK customers

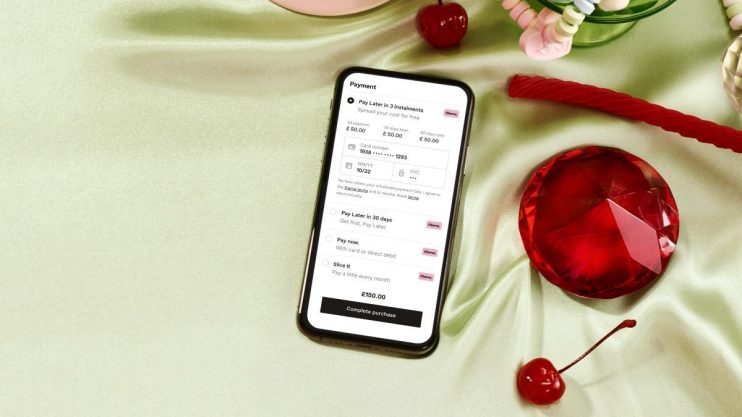

Klarna has announced the launch of a physical credit card for UK customers as it extends its buy-now pay-later (BNPL) products into ‘real world’ payments.

The card marks Klarna’s first foray into offline in-store purchases in the UK and will allow shoppers to pay anytime up to 30 days after buying, with additional payment options planned for future.

Alex Marsh, Head of Klarna UK, says: “Consumers are rejecting credit products which charge double-digit interest rates while allowing repayments to be put off indefinitely.

“For online purchases where credit makes sense, BNPL has become the sustainable alternative with no interest and clear payment schedules.”

Marsh said the launch of the Klarna Card in the UK now “brings those benefits to the offline world”.

The card already has a waiting list of 400,000 consumers in the UK, the firm said, after recently launching to more than 800,000 consumers across Sweden and Germany.

The launch of the card comes amid growing concern over the availability of unsecured credit in the UK and a looming regulatory clampdown on BNPL products offered by firms like Klarna and Clearpay.

A new survey from financial charity the Centre for Financial Capability (CFC) found that over a third of Londoners who have used a payment scheme that spreads the cost of buying have been hit with late payment fees

Consumer watchdog Which? this month called for stronger safeguards after it found consumers did not understand they were taking on a form of debt when they used BNPL.

Government is expected to introduce regulation to BNPL later this year or in early 2023.