Kazakhmys hit by ENRC stake sale in first half

COPPER miner Kazakhmys yesterday said it had taken a $823m (£528m) hit from the sale of its 26 per cent stake in peer ENRC, as it posted a first-half loss of $962m.

The FTSE 250-listed firm plunged into the red from a $122m profit in the same period last year and announced that it had scrapped this year’s dividend.

Kazakhmys will make $875m from selling its holding in scandal-ridden ENRC, which will be used to pay off debt, but the impairment shows how far the value of its asset has dropped.

First-half earnings fell from $1bn to $714m, with increased output failing to offset lower metal prices and rising industry costs.

Copper cathode output rose by seven per cent to 144,000 tonnes in the first half of the year and Kazakhmys said that full-year output will be at the higher end of its forecast range of 285,000 to 295,000 tonnes.

“Rising industry costs over the past few years have created a significant challenge for Kazakhmys, reducing profitability and cash generation,” said the firm.

“We have seen some improvement in cost inflation to date in 2013, but further cost reduction is a key priority for management with the objective of generating sustainable positive cash flow from our core copper operations.”

Kazakhmys did not give much detail of cost cuts but said it would scale back mid-sized projects and had temporarily suspended a number of mines.

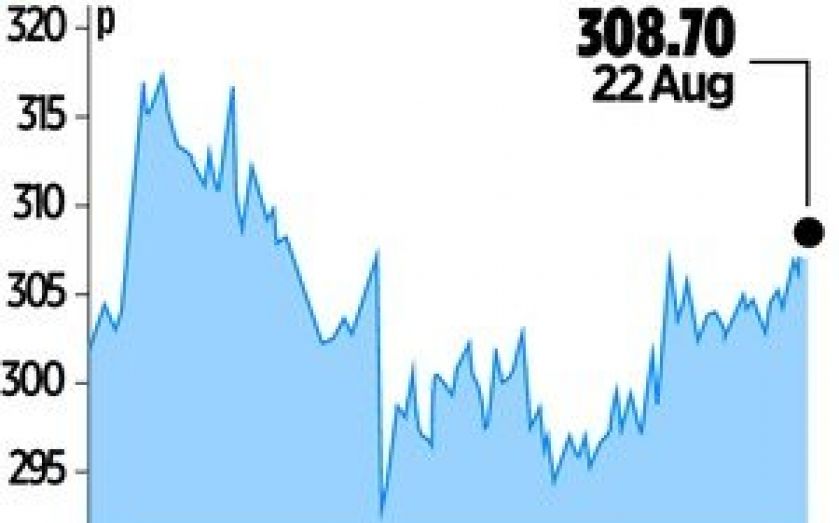

Shares closed up 2.4 per cent at 308.7p yesterday.