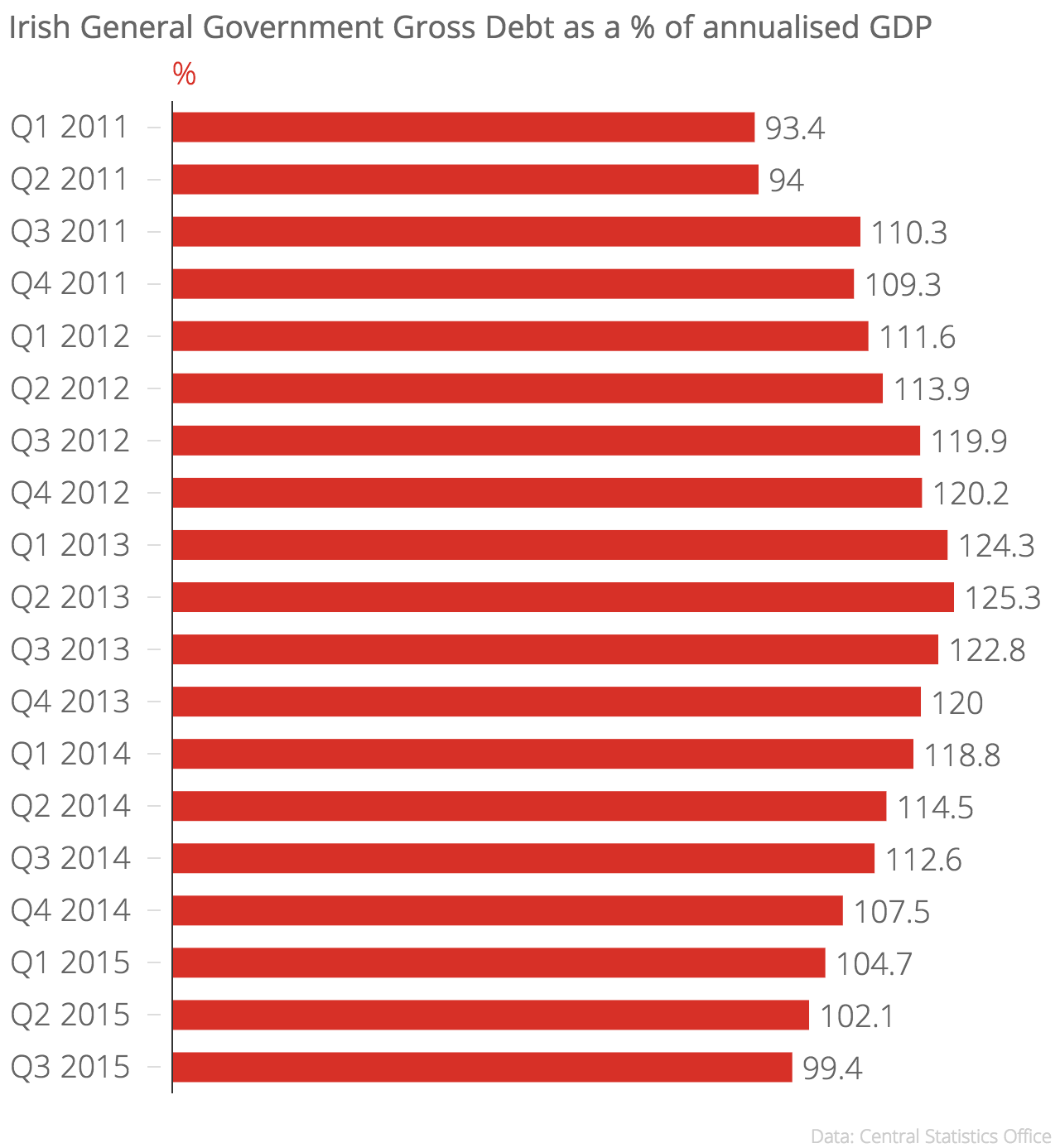

Irish government debt falls below 100 per cent of GDP mark to 99.4 per cent, or €204.2bn in money terms

General government gross debt in Ireland has fallen below the 100 per cent of GDP mark for the first time since 2011.

According to figures released today by the Central Statistics Office, general government gross debt in the country for the third quarter of 2015 was €204.2bn (£157.2bn), which is 99.4 per cent of annualised GDP.

By comparison, in the third quarter of 2014, gross debt stood at €208.2bn, which was 112.6 per cent of annualised GDP. In the second quarter of 2015, gross debt was €204.4bn, which was 102.1 per cent of annualised GDP.

The Office said the falling ratio was thanks to growth in GDP during the more recent period.

This debt level is the first time gross debt has been below 100 per cent of GDP since the second quarter of 2011, when the ratio was 94 per cent.

Meanwhile, general government net debt for the third quarter of 2015 was €165.9bn, which is 80.8 per cent of annualised GDP, and the deficit for the period was €1.2bn.

Commenting on the figures, Diego Iscaro, senior economist at IHS Global Insight, told City A.M.:

"The public finances have benefited from very strong economic recovery. GDP is likely to have grown by around seven per cent in 2015 – making Ireland the fastest growing Eurozone economy by a large margin – and activity is expected to remain strong this year. The budget for 2016 was the first decidedly expansionary budget since the start of the crisis, although we do not expect the fiscal finances to be significantly affected this year as long as growth remains strong."