Investors cheer as Dixons pays €25m to solve Italian problem

DIXONS Retail, Europe’s second-biggest electrical goods retailer, yesterday agreed to pay €25m (£21m) to merge its loss-making UniEuro business in Italy with a firm controlled by private equity group Rhone Capital.

Dixons’ plan is to focus on markets where it has a leading position and combined stores and internet business, such as the UK, Nordics and Greece. Last month the firm, home to the Currys and PC World chains in Britain, Elkjop in Nordic countries and Kotsovolos in Greece, struck deals to sell its loss-making French e-commerce business PIXmania and Turkey’s ElectroWorld, leaving Italy as its remaining headache.

Dixons said yesterday it had signed a deal with the shareholders of SGM Distribuzione, which trades as Marco Polo in Italy, to form a new company that will own both UniEuro and Marco Polo, sending its shares higher.

Rhone Capital is the controlling shareholder of Marco Polo and will become the controlling shareholder of the new merged company. In total the owners of Marco Polo will own 85 per cent of the merged business, while Dixons will own 15 per cent.

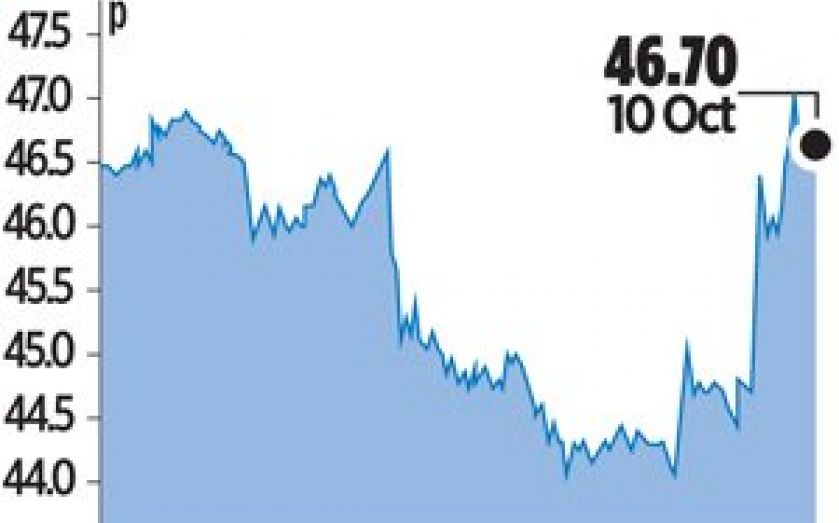

Shares in Dixons, which have more than doubled over the last year, closed up 5.8 per cent at 46.70p.