Hochschild Mining stock price recovers after proposed ban from Peru

Hochschild Mining investors rejoice following confirmation that the mining firm will be able to continue its operations in Peru, pushing its stock price up more than 14 per cent.

The London-listed miner was facing a ban from southern Ayacucho, Pallancata and Inmaculada at the beginning of the week, after the Peruvian head of cabinet indicated that approvals for more mining or exploration will no longer be granted following environmental complaints.

A local government meeting also suggested a timetable and terms for the closure of certain mining projects in those regions.

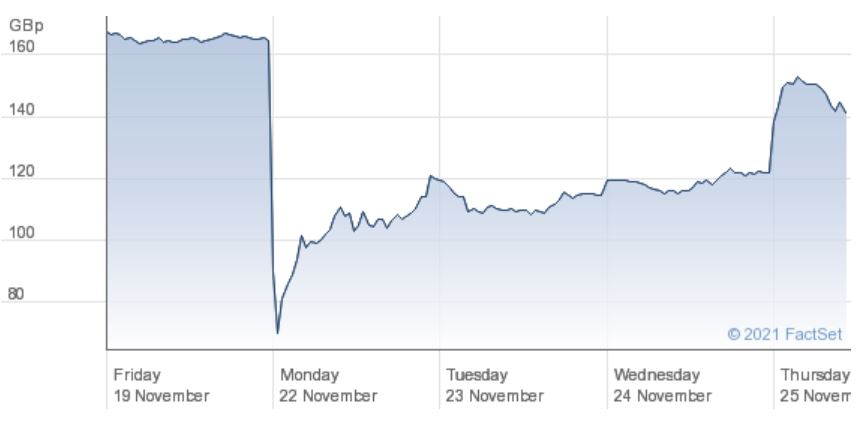

It was a tough Monday for the miner, as its share price plunged from 164.6p to just 70p. Hochschild’s share price has today steadied at around 140p by close of play.

CEO Ignacia Bustamante said that the mining firm welcomed the clarification from the Peruvian government, which followed several discussions between senior members of the cabinet and mining representatives.

“We are pleased that our Inmaculada and Pallancata mines can continue to operate without further uncertainty and, furthermore, we reaffirm our goal to increasing our resources and extending our mine lives, in accordance with current legislation,” the mining boss said in a statement today.

The mining firm employs more than 5,000 people directly and around 40,000 people indirectly in Peru.