Hiscox shores up flood reserves as earnings rise

SPECIALIST insurer Hiscox yesterday revealed a 12.4 per cent jump in annual pre-tax profit to £244.5m, as the glut of hurricane and catastrophe claims seen in 2012 did not repeat itself.

Chief executive Bronek Masojada said it had been “a very good year” for the London-listed group.

“We are excited about the opportunities we see in many retail markets where we have room to grow profitably. In our big ticket areas, discipline and opportunism will guide us,” he said.

The insurer has been vocal about the impact of Flood Re, the agreement brokered by the government and the insurance industry to cope with rising premiums for home-owners living in areas at high-risk flooding.

Hiscox is particularly concerned that the scheme will not be fair to those it excludes and that it will cost considerably more than the quoted £10.50 per home in some areas of the UK.

The group reassured investors that the recent bad weather in the UK was within expected limits. However, it added that while it had already set aside £11m for claims in December, it would put a further £5m by for claims related to UK flooding and storms in the first part of this year.

The group has warned that its reinsurance business will continue to shrink in 2014, after it saw a 16 per cent decline in 2013 owing to aggressive competition in the market.

A special dividend of 36p per share was also announced yesterday.

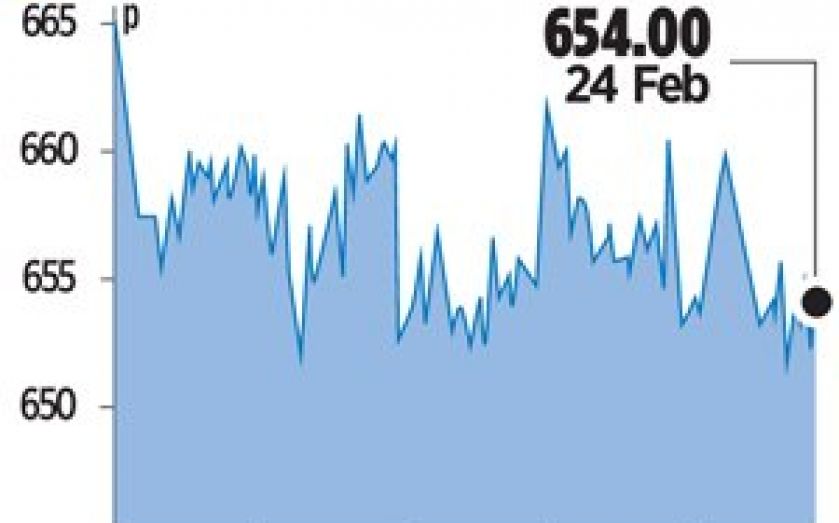

Shares had a rollercoaster day of trading, opening sharply lower before recovering to close down just 0.3 per cent.