High house prices and strong rent growth lift landlord returns

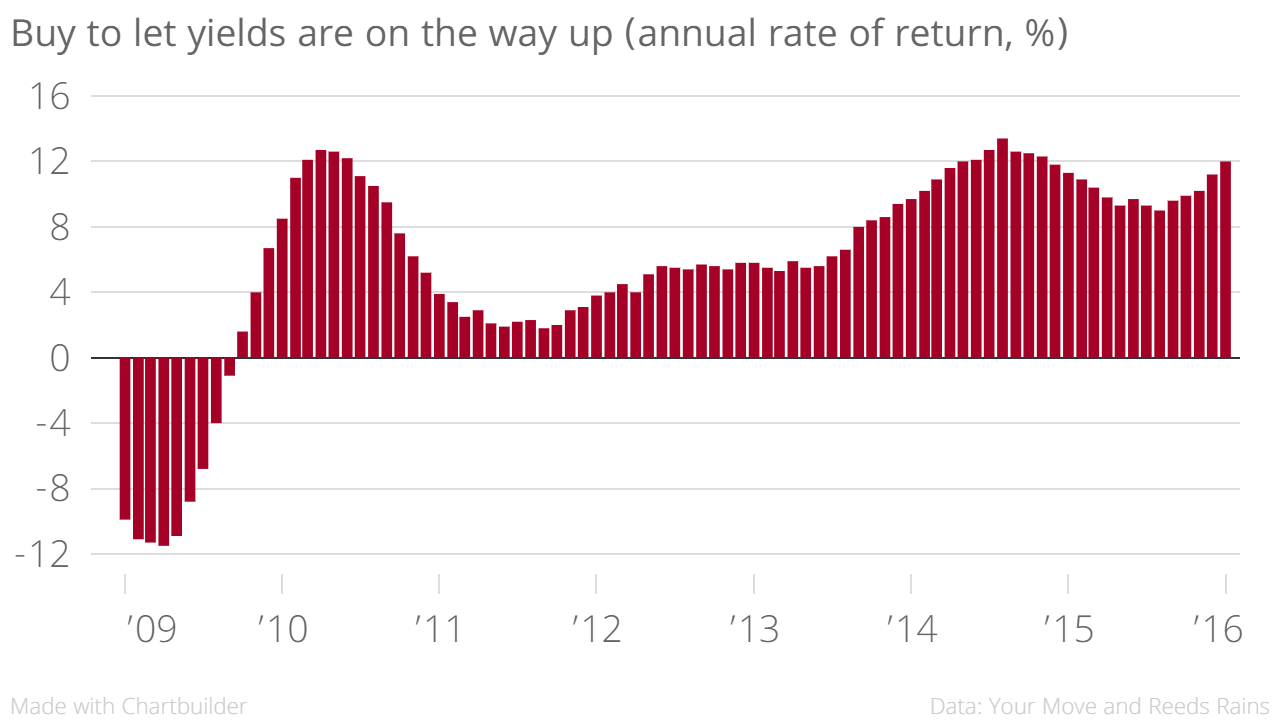

Landlords' annual returns have reached their highest for over a year, according to figures released this morning.

Considering both the growth in rents and increases in property prices, landlords’ annual rate of return in January was 12 per cent.

The figures, from estate agents Your Move and Reeds Rains, show that the average landlord in England and Wales have made a return of £21,988 over the last 12 months, before deductions such as maintenance and mortgage payments.

Rising property prices contributed £13,596 to this while rental income made up £8,394.

“Buy to let returns are building and property prices are picking up as the housing shortage across the UK intensifies,” said Adrian Gill, director of Your Move and Reeds Rains estate agents.

But the year ahead has a few bumps in the road for buy to let investors, such as a higher rate of stamp duty on their property purchases.

“Stamp duty premiums on new buy to let purchases are the rhino in the room – everyone is talking about the 1 April deadline and the extra purchase costs are perceived by some commentators as potentially hazardous. But this is a little simplistic.”

“The rules around UK property are changing – but there is no bull in the buy-to-let china shop.

He said the removal of tax relief on mortgage interest payments would have a bigger impact on landlords. Buy to let investors used to be able to subtract interest payments on their mortgages from the income revenue, reducing their tax burden. This new system will be phased in from 2017.

“Right now in 2016 the big shift is likely to be in favour of existing landlords, potentially at the expense of those planning to start up as a landlord for the first time or expand their portfolio. As such, it will be interesting to see how the rental market responds if there is a disruption to investment in supply,” Gill said.