Government in danger of missing nuclear targets, warns industry boss

The Government is in danger of missing pledged targets to ramp up nuclear power and ensure the country’s supply security if it fails to greenlight new projects this month, warned the boss of a leading industry body.

Tom Greatrex, chief executive of the Nuclear Industry Association (NIA), told MPs at the Welsh Affairs Committee that Russia’s invasion of Ukraine and the Kremlin’s subsequent squeeze on supplies had “focused minds” on the energy security challenge the UK faces.

He urged Downing Street to push forward with both the proposed new Sizewell C power plant and small modular reactors this month – with the industry boss expecting to see progress made in the coming weeks.

He said: “Frankly, if we don’t, we are putting in jeopardy the ability to get in anywhere close to the energy security strategy prognosis of 24GW by 2050. I know 2050 sounds a long time away, but it really isn’t if you are looking to develop a secure, reliable decarbonised power supply.”

The Government announced plans to more than treble the UK’s nuclear capacity as part of its energy security strategy launched in April, with Boris Johnson pledging eight new reactors by the end of the decade while committing £700m of state funding in one of his final acts as Prime Minister.

It has also appointed Simon Bowen as an industry advisor to the Department for Business, Energy and Industrial Strategy (BEIS).

He will help drive proposals for a new Great British Nuclear vehicle – a new body which was announced as part of the security strategy.

Sizewell C approval key for future projects

While the energy security strategy remains intact, it is unclear whether the new administration overseen by Prime Minister Rishi Sunak will be equally supportive of the power source – with Downing Street having to deny reports as recently as last week that Sizewell C’s funding could be reduced.

This follows the costs of Hinkley Point C ballooning from £18bn to £26bn, with its completion date pushed back from 2023 to 2027.

Chancellor Jeremy Hunt and Business Secretary Grant Shapps are scrambling to shore up the nation’s finances to close a £50bn fiscal black hole amid soaring inflation and a looming economic downturn – leading to speculation potential energy projects could be scaled back.

Sizewell C is a proposed 3.2GW nuclear power plant, based in Suffolk, nearly identical in design to Hinkley Point C.

It has the potential to power six million homes and provide seven per cent of the UK’s energy needs.

Julia Pyke, head of financing at Sizewell C, confirmed at the committee meeting that the plant is now waiting to designated for a regulated asset base model licence from the Government – which will enable the initial construction phase before private funding kicks in at a later stage.

The Government is set to take half the shares in Sizewell C, with Pyke hoping a clear programme of raising money in financial close over 12-18 months.

Estimates for its overall cost vary wildly from £20-35bn.

Pyke said she was hoping to see a supportive statement as part of tomorrow’s fiscal event.

She said: “Sizewell C will demonstrate the benefits of the Government’s policy of introducing the RAB model. There will be a clear way of financing, and people will no longer say ‘But how will it be financed?’, as we will have a template.”

The finance leader also argued that the potential site Wylfa site in Angelsey, North Wales, was dependent on a pipeline of power plants being pushed through – with the Welsh project potentially next in line as a GW nuclear project after Sizewell C.

She said: “We need to get Sizewell C over the line, we need to keep the momentum in the programme. Then there needs to be a decision over whether there is going to be a GW plant.”

Rolls-Royce commits to SMR ramp up

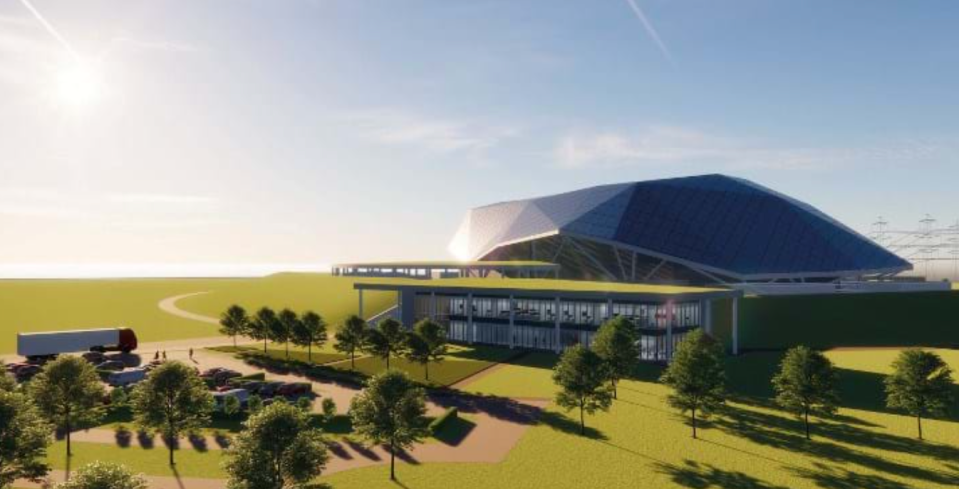

Earlier this month, Rolls Royce announced it is looking to secure as many as 30 sites for small modular reactors, which could each generate 470MW of power.

It has earmarked three sites as priorities for development including Trawsfynydd in Wales, alongside Sellafield in Cumbria and Oldbury near Bristol, as priorities for development.

The former nuclear sites are all owned by the Nuclear Decommissioning Authority, which is weighing up bids from a number of potential SMR developers.

It entered into a memorandum of understanding with the Welsh government to help support their development of a new small scale nuclear project in North Wales.

This follows the announcement earlier this year from BEIS that the NDA would work alongside stakeholders, including Cwmni Egino, to enable engagement on potential future nuclear developments in the UK.

Currently, nuclear power is responsible for around 16 per cent of the UK’s energy mix, but this will decline without investment in new power plants.

The UK is set to close six nuclear reactors over the course of the decade, making further projects urgent as it looks to boost nuclear power generation to as much as 25 per cent of the country’s overall energy generation.