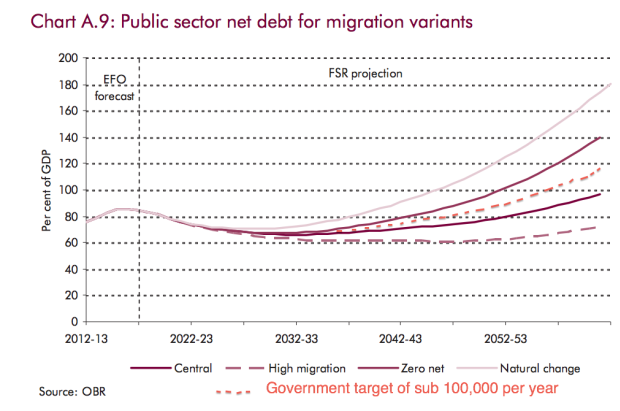

Government immigration cap would see debt to GDP rise to 120pc by 2062

The OBR has crunched the numbers to see what happens to the national debt at varying rates of immigration.

If the UK sees net inward immigration of 140,000 per year the national debt hits 100 per cent of GDP in 50 years' time. At zero it hits 140 per cent.

The reason migrants help the finances is that they tend to be of working age, so don't need the UK to pay for their education, and sometimes leave the country before taking pensions and old age healthcare.

But neither of these forecasts show what happens if the government hits its target of cutting net immigration to "tens of thousands" per year.

Not to worry, though – Professor Steve Nickell from the agency suggests drawing a line between the two forecasts to get immigration of roughly 70,000 per year, in line with the government's goal.

We've got our most artistic statistician on the job, and that line shows the UK's debt to GDP ratio will rise to 120 per cent by 2062 if immigration is cut that much – so the debt will be 20 percent bigger as a share of GDP if the government's clampdown succeeds.