Goldman close long option for gas trading after unexpected production results

Goldman Sachs has closed its long call option trading recommendation for gas. The trade, which was first recommended by Goldman in April of this year at an initial value of $0.31, has a current value of $0.01.

Goldman had expected a tighter balance through the summer, but US natural gas year-on-year production actually accelerated to 1.3 billion cubic feet per day (Bcf/d) from 0.4 Bcf/d in the first quarter of this year.

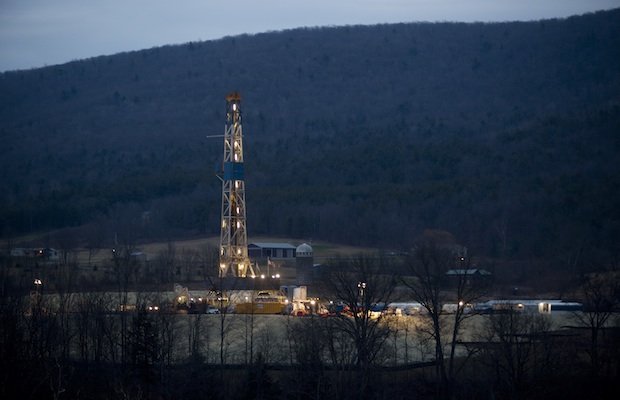

Gas production was boosted by the Marcellus region – which runs through Ohio, south west Pennsylvania and West Virginia – softening the balance sufficiently to mean coal-to-gas substitution was key for the market balance this summer. Added to this, Appalachian coal prices were slightly lower than Goldman expected when they first recommended the trade. Summer weather also had a small positive impact on inventory injections and also contributed to a softer balance and, therefore, to lower-than-expected US natural gas prices.

Production growth slowed year-on-year in September and has actually been negative so far in October. This is in part storm-related – production was disrupted in the Gulf of Mexico earlier in the month – but Marcellus production has now stabilised for the time being.

If this slowdown is driven by regional logistical issues in moving natural gas, says Goldman, there is a risk that US production will re-accelerate when new pipelines are added in the area. Unless a colder-than-average winter comes along, this poses a downside risk to the investment bank's natural gas forecast – $4.25/mmBtu 2014 NYMEX.

Goldman's now closed recommendation was to go long $4.20/mmBtu call options on November 2013 NYMEX natural gas for a potential loss of $0.30.