FTSE 100 stock market turmoil: What does this mean for the rest of the year?

Britain's FTSE 100 index had its worst ever start to the year last week, wiping around £85bn off the UK's most valuable companies – but what does this mean for the rest of 2016?

The blue-chip index shed three per cent last week to finish at 5,912.40 points – back below the psychologically important 6,000 mark. It suffered as turbulence on China's stock markets exacerbated concerns over the pace of its economic slowdown.

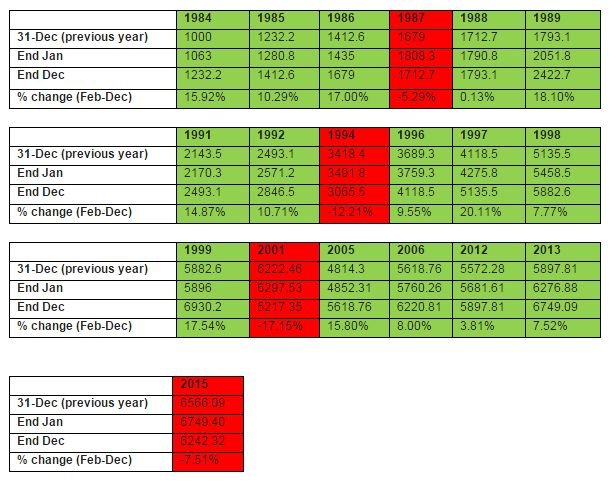

Research by fund manager Fidelity shows a positive start to the year led to further rises for the remainder of that year 79 per cent of the time since the index's inception in 1984. It added that the success rate "suggests that there might be more than mere chance to this."

In the 13 years the FTSE had a negative first month, though, the market reversed that trend on eight occasions, ending the year in positive territory. There were five years where the downward trend continued for the rest of the year, which is around 39 per cent.

There's much debate over whether the so-called January effect, referring to the belief positive markets in the first month of the calendar year lead to gains in the subsequent 11 months, is a myth or a money maker.

Read more: FTSE 100 index opens lower as concerns over the Chinese economy persist

"There is an old adage that states ‘as goes January, so goes the year’. While the January effect may not have come off last year, it is hard to argue against the statistics which show that a positive January has led to further rises four out of five times during the past 32 years," Tom Stevenson, investment director for personal investing at Fidelity International, said.

"Even when the FTSE 100 has got off to a poor start in January, there’s a silver lining for investors. In the 13 years in which the FTSE 100 has had a negative first month, the market reversed that trend on eight occasions, going on to end the year at a higher rate. In five years, the down trend continued for the rest of the year.”

(Source: Fidelity)