Firms cut out Eurozone’s banks when looking for debt finance

MARKETS still do not trust Europe’s banks, leaving them with higher funding costs than the banks they want to service, the bank of International Settlements (BIS) said yesterday.

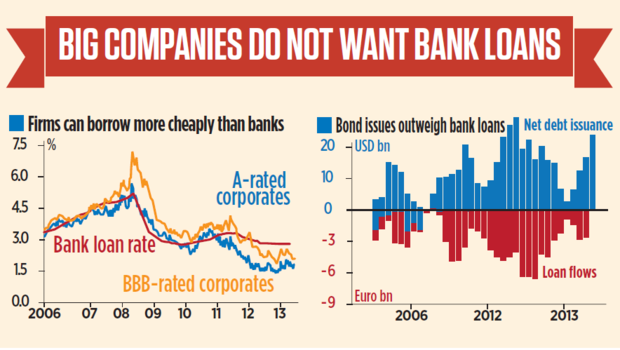

Banks must pay an average of more than three per cent, while an A-rated company can pay below two per cent for an equivalent loan and a triple-B rated firm just above two per cent to borrow in the capital markets.

It comes after years in which firms have already been pushed into the bond markets as banks cut back on lending.

As a result BIS predicts the reliance on capital markets could become a permanent feature of the finance landscape, cutting down banks’ market share.

“The erosion of banks’ funding advantage limits their effectiveness as intermediaries,” said its report.