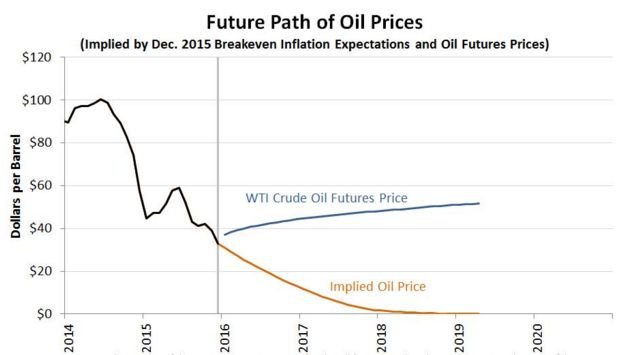

Fed Reserve Bank of St. Louis: Why oil prices could fall to zero by mid-2019 despite markets predicting $50 per barrel

One calculation suggests oil prices could fall to zero by mid-2019.

Two St. Louis Fed analysts looked at how low oil prices could fall given tumbling inflation expectations, and found it's largely out of whack with market expectations for the black stuff to recover to $50 per barrel in around three years' time.

"According to our calculations, oil prices would need to fall to $0 per barrel by mid-2019 in order to validate current inflation expectations," economist Alejandro Badel and research associate Joseph McGillicuddy wrote.

"After that, there is no oil price that would allow our model to predict consumer price index (CPI) path consistent with December 2015 breakeven inflation expectations."

"This implied path of oil prices is very different from the path of oil prices implied by futures contracts, which rises to more than $50 per barrel by mid-2019."

(Source: Federal Reserve Bank of St. Louis)

The researchers note tumbling oil prices have coincided with a fall in breakeven inflation expectations, as measured by the premium paid for treasury inflation-protected securities (TIPS) over standard treasury bonds.

Working from the assumption that the fall in breakeven inflation rates reflects a fall in actual inflation expectations, and assuming it's primarily driven by a fall in oil price expectations, they ask how low future oil prices would have to fall to match current inflation expectations.

To do so, they investigated the future path of the consumer price index (CPI) as implied by inflation expectations. They then backed out a future trajectory for oil prices in line with this.

The researchers aren't predicting oil will eventually be worthless, their model contains unrealistic assumptions such as non-energy components of the CPI continuing to grow at 2.87 per cent over the next 10 years.

But their analysis does highlight a big discord between where the market implies oil prices will be in the future compared to what's indicated by inflation expectations.