Fed caution gets undermined by strong US data

BEN Bernanke’s surprise decision not to dial down the Federal Reserve’s money printing, which he justified on Wednesday by pointing to an uncertain US economy, was embarrassed by a sheaf of positive economic news revealed yesterday.

The Federal Open Market Committee announced on Wednesday that it would “await more evidence that progress will be sustained” before clipping its $85bn (£52.88bn) of monthly asset purchases. But a number of announcements yesterday suggested that the recovery is well underway.

In industry, the Philadelphia Federal Reserve released its best survey results in 40 months, signalling strength in the US economy’s manufacturing sector this month.

The housing market also continued to improve, with sales of existing homes in August reaching a level last seen in February 2007, before the financial crisis or subsequent recession. There were 5.48m transactions last month, up by 13.2 per cent from August 2012.

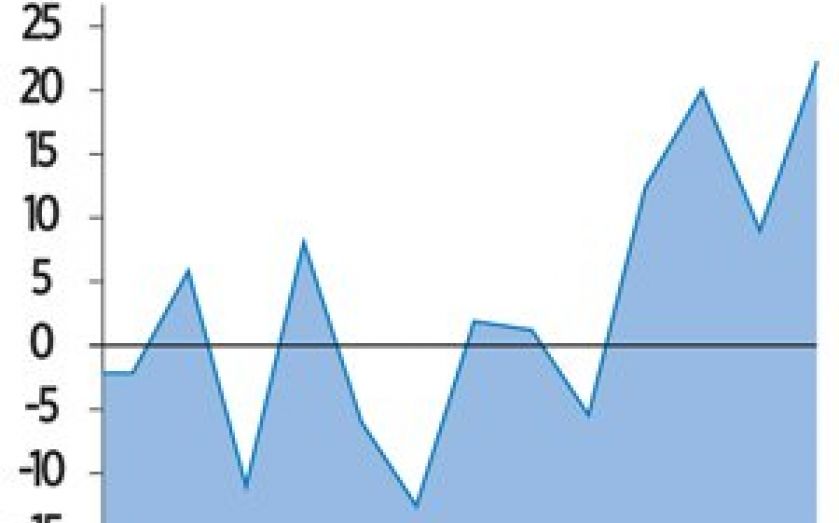

After the Federal Reserve announced that the reduction would not go ahead this month, as many had expected, the S&P 500, NASDAQ and Dow all spiked to record highs, while the dollar slipped against other currencies and gold surged in value.

Although the Fed announced that it would look for substantial improvements to the labour market before reducing QE, new information on unemployment also appeared to indicate a strengthening climate for jobs.

The number of initial claims for unemployment benefits rose to only 309,000, around 20,000 less than was expected by forecasters. Paul Ashworth of Capital Economics commented: “The recent drop off in claims suggests the labour market outlook has improved, possibly significantly.”

As the US continues to import less oil, the country’s current account deficit also narrowed to $98.89bn during the second quarter. At 2.4 per cent, the US now has its lowest current account deficit for 15 years, when compared to the size of the economy.

The trade deficit on both goods and services decreased from their level in the first quarter.

- The Fed’s taper surprise highlights a wider problem with monetary policy

- Analyst Views: What did you make of the Federal reserve’s decision not to taper its quantitative easing programme?