February’s top and bottom performing funds

Concerns about rising interest rates in the US resulted in a nerve-jangling start of February for share investors. Data released showed that US wages are rising while unemployment is at a 17-year low. Higher wages imply higher inflation, which makes a steeper path of interest-rate rises more likely, and this impacts the cost of borrowing and company profitability. It also increases the required return investors are looking for, putting pressure on share prices.

The market has since recovered some poise but few fund sector averages showed positive returns over the month. It seems volatility has now returned after more than a year of record calm, though we believe the bull market has further to run and these falls presented a buying opportunity. We do not believe that Jerome Powell, the new chair of the Federal Reserve, will tighten too aggressively and that global growth has moved up a gear to compensate for inflationary pressures.

The looming prospect of Brexit continued to weigh on sentiment towards UK shares, even though there were indications that the UK economy will hold up better than previously forecast. Consumer confidence rose at the fastest pace in a year in January, according to a YouGov survey, and inflationary pressures, which spiked following the result of the referendum, have started to abate. It wasn't enough to lift UK fund sectors and these feature prominently in the bottom ten along with European equities, which were dealt a blow by a rare negative shock for the German economy. Sentiment among German businesses fell significantly more than expected according to a business climate gauge.

Asia and Emerging Markets were among the areas hardest hit during the sell off early in the month as investors sought to take profits from previously strong-performing areas. Technology stocks performed well amid the volatility, though, with investors quick to buy into the leading tech names when markets fell. Meanwhile, some Japanese funds eked out positive returns over the month largely thanks to the strengthening yen which was seen a safe haven amid the turmoil. Funds hedging the currency fared poorly as share prices were generally lower.

Bonds were of course at the epicentre of fears over an overheating US economy and higher inflation. Prices have been falling and yields rising since the turn of the year, but the tumble reached a crescendo with 10-year Treasury yields rising to close to 3%, a four-year high. However, bond sector averages were down only slightly over the months. For the rest of 2018 and we expect bond yields to rise relatively slowly, a gradual repricing that could still allow share markets to perform reasonably well.

Although investors should be aware past performance is not a reliable indicator of future results, here are the top and bottom ten Investment Association funds and sectors for February 2018 in full:

Top 10 funds:

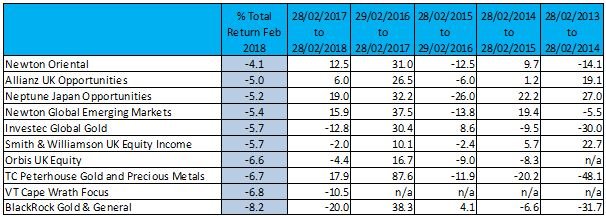

Bottom 10 funds:

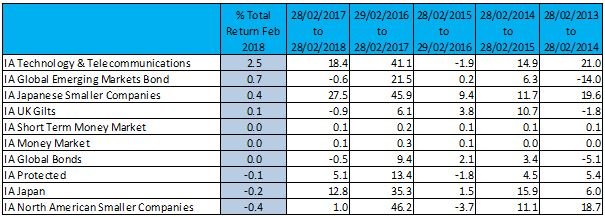

Top 10 sectors:

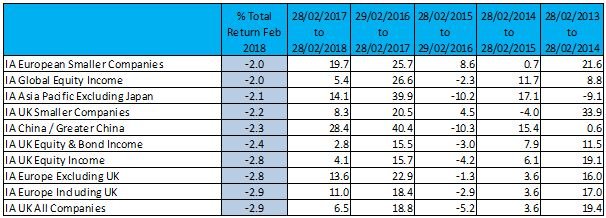

Bottom 10 sectors:

Past performance is not a reliable indicator of future returns. Figures are shown on a total return basis, bid to bid price with net income reinvested; Source: FE Analytics, data for February 2018: 31/01/2018 to 28/02/2018. Onshore and retail open-ended funds only.

This website is not personal advice based on your circumstances. No news or research item is a personal recommendation to deal. Investment decisions in collectives should only be made after reading the Key Investor Information Document or Key Information Document, Supplementary Information Document and/or Prospectus. If you are unsure of the suitability of your investment please seek professional advice.