Facebook launches cryptocurrency with backing of Uber, Visa and Spotify

Facebook has today published the white paper for its widely anticipated cryptocurrency initiative, with the founding support of several major businesses across multiple sectors.

Named libra after the Roman unit of measure once used to mint coins, the cryptocurrency will be managed by an independent eponymous association consisting of 28 initial founding companies.

Alongside Facebook and its new crypto-focused offshoot Calibra, other notable members include:

- Uber

- Vodafone

- Stripe

- Visa

- Mastercard

- Paypal

- PayU (Naspers’ fintech arm)

- Andreessen Horowitz

- Ribbit Capital

- Thrive Capital

- Coinbase

- Lyft

- Spotify

- Farfetch

- Booking.com

- Ebay

Facebook told reporters in a briefing last week that each member was required to invest a minimum of $10m (£8m) into the Libra Association in order to join. It will also soon raise funding for the association in a private placement.

The social media giant is currently the association’s largest sponsor, but all founding partner companies have equal voting rights. By the time libra launches fully in the first half of next year, the Geneva-based association hopes to have 100 partners.

Built on a brand new open-source blockchain and backed by its own reserve, libra is intended to be a global currency that can improve access to the financial system.

The coin will be tethered in order to reduce volatility, with the reserve supported by treasuries and central banks from the US, the UK, Europe, Japan, and Switzerland among others.

David Marcus, Facebook’s head of Libra, said the company had already begun meeting with regulators around the world – including the Bank of England – to garner support and advice for the initiative. He added that the firm had yet to receive a negative reaction to the concept.

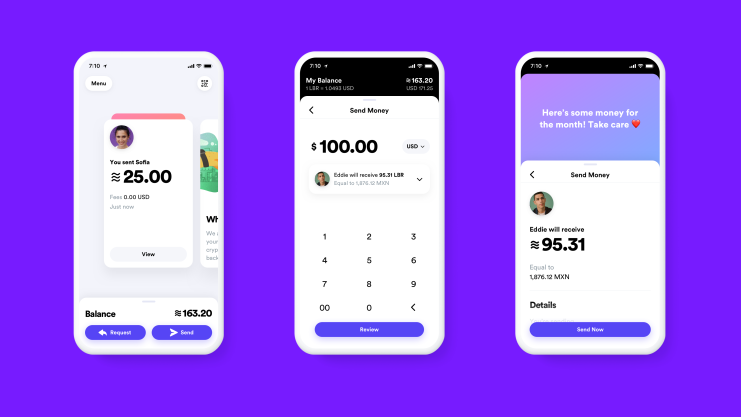

While Facebook will make no revenue from libra itself, it intends to monetise the venture through its subsidiary Calibra and the creation of a cryptocurrency wallet.

Upon launch, users will be able to send and receive libra to contacts as currency through Whatsapp, Messenger and the Calibra app, to be stored in the wallet until they wish to withdraw the funds.

“Change is coming whether we do this or not,” Marcus told reporters on a call last week.

“The way that this is structured with large trusted companies from all around the world, and with compliance in mind, is a better alternative than some completely uncontrolled new digital currency being launched into the world. That’s also a reassuring fact for regulators that will have a lot of weight.”

The launch of libra was preceded by a swathe of media leaks about the project, including Facebook’s hiring of a former Standard Chartered lobbyist to help with the initiative.

Critics have voiced concerns about whether Facebook should be involved in such an endeavour, given its poor track record on data privacy and cyber security.

“If this was a Facebook-owned, operated and controlled network, they would be right,” said Marcus. “But that’s not what we’re doing.”

Alex Norstrom, Spotify’s chief premium business officer, said: “One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems – especially for those in financially underserved markets.

“This creates an enormous barrier to the bonds we work

to foster between creators and their fans. In joining the

Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.”