ExxonMobil beats expectations – despite oil rout

The figures

The world's largest oil company – which was, until recently, also the world's largest company – has wowed its detractors, posting revenues of $67.6bn (£43.9bn) in the three months to the end of March. Admittedly, that's 36 per cent down on last year – but it's still well ahead of expectations of $55bn.

Upstream earnings were hit hardest, falling 41 per cent to $2.9bn – indeed, its US upstream business was pushed into a $52m loss, down from a $1.2bn gain during the same period last year.

Its non-US operation fared rather better, with earnings of $2.9bn, although that was nevertheless under half the $6.5bn it posted last year.

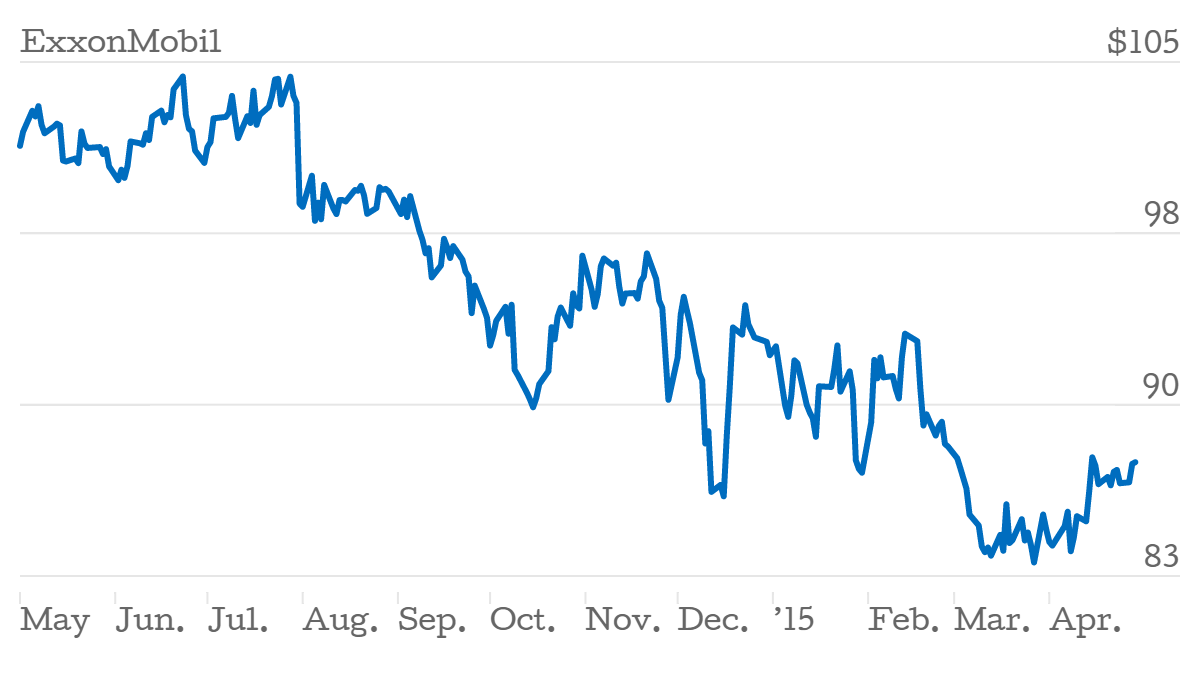

But the company produced 4.2m barrels of oil a day, an increase of 97,000 on the first quarter of last year. With volumes up 2.3 per cent, investors were clearly sanguine: shares opened one per cent up in US trading, at $88.60 – although they fell back slightly as the day wore on.

Why it's interesting

With oil prices plummeting at record speeds over the past few months, the black stuff is always interesting. Particularly given it's some of the world's largest oil producers – including BP, which this week reported earnings down 20 per cent – which have been hit hardest.

In recent weeks prices have begun to creep up, but it may be too late for a sector which reacted by scrapping or delaying multi-billion dollar investment programmes.

But although Exxon has been hit alongside its peers, its sheer size gives it an advantage: as its rivals' share prices have fallen, they've become ripe for acquisition. Analysts have speculated Exxon could manoeuvre to absorb one of several of the largest oil producers, including, controversially, BP.

The Conservatives aren't particularly keen on the idea – on Tuesday, they said they would definitely block a foreign takeover of the company. Nevertheless, it's an interesting thought.

What ExxonMobil said

Rex W. Tillerson, Exxon's chief executive and chairman:

Regardless of current market conditions, we remain focused on business fundamentals and competitive advantages that create long-term shareholder value.

In short

In a difficult market, it's about survival of the fittest – or survival of the largest, anyway. The question now is whether ExxonMobil will also choose to consolidate.