Is Europe turning Japanese? Barclays really thinks it could be

Is the Eurozone falling into a deflationary spiral?

Two more bleak pieces of research earlier suggest that at best, Europe’s inflation outlook is failing to improve, and at worst, it may face a “Japan-style deflation cycle”.

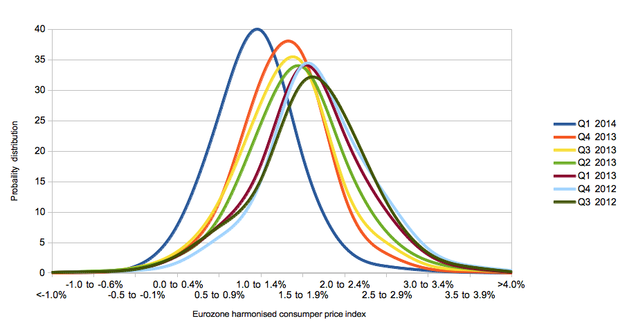

The European Central Bank’s monthly bulletin’s survey of forecasters suggests disinflation is still going on – they project 1.1 per cent inflation this year and 1.4 per cent in 2015, down 0.4 and 0.2 percentage points from their last poll.

Professional forecasters have continually nudged back their expectations for inflation in the Eurozone this year, but the jump towards a lower expected rate has been particularly notable this quarter.

Is Europe turning Japanese?

Barclays researchers also revealed this morning that they are taking the possibility of deflation more seriously than some others.

Our assessment is that the risks of a region-wide, deflationary period are significant, and certainly bigger than what is currently priced into financial markets or being publicly acknowledged by eurozone policymakers. In any case, the likelihood of a prolonged period of falling price levels in at least several eurozone countries looks high.

Deflation is already the reality for Greece and Spain, while Portugal, Slovakia and Spain all saw inflation of less than 0.5 per cent in 2013, and thinks

The bank concludes on a grim note:

Today is much like Japan’s crucial 1996-97 period. Then, the combination of significant shocks, negative demographics, undercapitalized banks and an expensive exchange rate left Japan on the cusp of deflation. While these deflationary forces are not as large in the eurozone today, the added deflationary pressures from tight fiscal policy, tight monetary policy (region-wide, and certainly in some countries), internal devaluations and global disinflationary pressures means the eurozone’s risks are not meaningfully different than they were in Japan in 1996-1997.

Does it really matter?

Centre for Economic and Policy Research co-director Dean Baker has also taken pundits to task for an excessive focus on deflation alone.

There is no particular importance to crossing zero in this story. If the inflation rate falls from 1.5 percent to 0.5 percent, this will make investment look less profitable. The same is true if it falls from 0.5 percent to -0.5 percent. The problem faced by euro zone countries (as well as Japan and the United States) is that it would be desirable to have a higher inflation rate to make investment more profitable. This is just as true when the inflation rate is a very low positive number as when it is a negative number and countries face deflation. The problem is simply too low a rate of inflation.