EU gas supplies in strong shape after winter of mass rationing

The EU has emerged from winter with its energy supplies in robust shape, with storage levels above average and gas prices falling closer to historical norms.

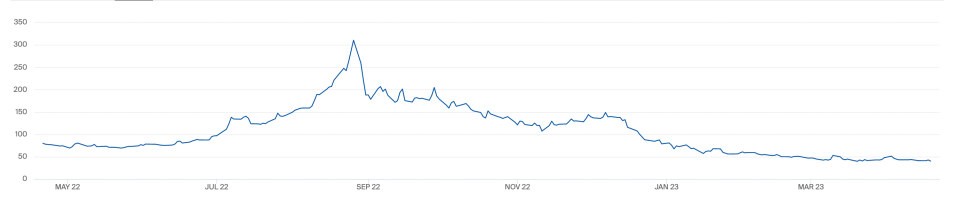

Europe’s key gas benchmark, Dutch TTF Futures, has fallen from about €75 per megawatt hour at the end of December to near €40 per MWh this month.

While prices remain around double the price of pre-crisis standards, the current levels contrast vividly with the record prices of €343 per MWh in August.

Looking to next winter, industry body Gas Infrastructure Europe reported that the EU’s gas storage reached 55.7 per cent of capacity at the start of the month, 20 percentage points above the average for the past five years.

This has been driven by reduced consumption of natural gas across the EU, which plummeted 18 per cent in the eight months up to March, helping the troubled bloc stave off supply shortages and avoid blackouts.

This was compared with the same eight-month periods over the previous five years.

The large drop in gas usage, as reported by Eurostat, followed Russia’s throttling of pipelines into Europe in retaliation to Western sanctions following Russia’s invasion of Ukraine.

It also reflected sustained energy conservation efforts across the continent, which included the shutdown of some industrial activity and power rationing, and the fortune of a milder than expected winter.

The overall reduction (17.7 per cent) even surpassed the EU’s proposals to slash its reliance on Kremlin-backed fossil fuels, with the bloc targeting a 15 per cent reduction target for energy usage ahead of last winter.

The biggest declines were registered in the second part of 2022 starting in August, with a 14.0 per cent reduction in consumption, followed by 14.3 per cent in September, 24.4 per cent in October, 25.0 per cent in November and 12.3 per cent in December.

The EU started the year with further decreases of 19 per cent in January and 14.7 per cent in February.

Over the eight-month window, consumption fell the most in Finland (55.7 per cent), Lithuania (40.5 per cent) and Sweden (37.2 per cent).

Data showed that the majority of EU countries reached the 15 per cent target, with the exceptions being Ireland (0.2 per cent), Slovakia (1.0 per cent), Spain (10.8 per cent), Poland (12.5 per cent), Slovenia (13.8 per cent) and Belgium (14.5 per cent), while Malta (the smallest gas consumer among all EU members using gas), actually saw a 12.7 per cent increase between August 2022 and March 2023.

These figures follow the EU-US taskforce on energy revealing the bloc has reduced the proportion of its gas imports from Russia to 16 per cent at the end of last year, down from 37 per cent in March 2022.

While the West is set for challenging winters as it shifts away from Russian supplies to new gas partners and renewables, its heavy consumption cuts have kept the EU in strong shape heading into next winter.