Ether demand boom sparks liquidity crisis?

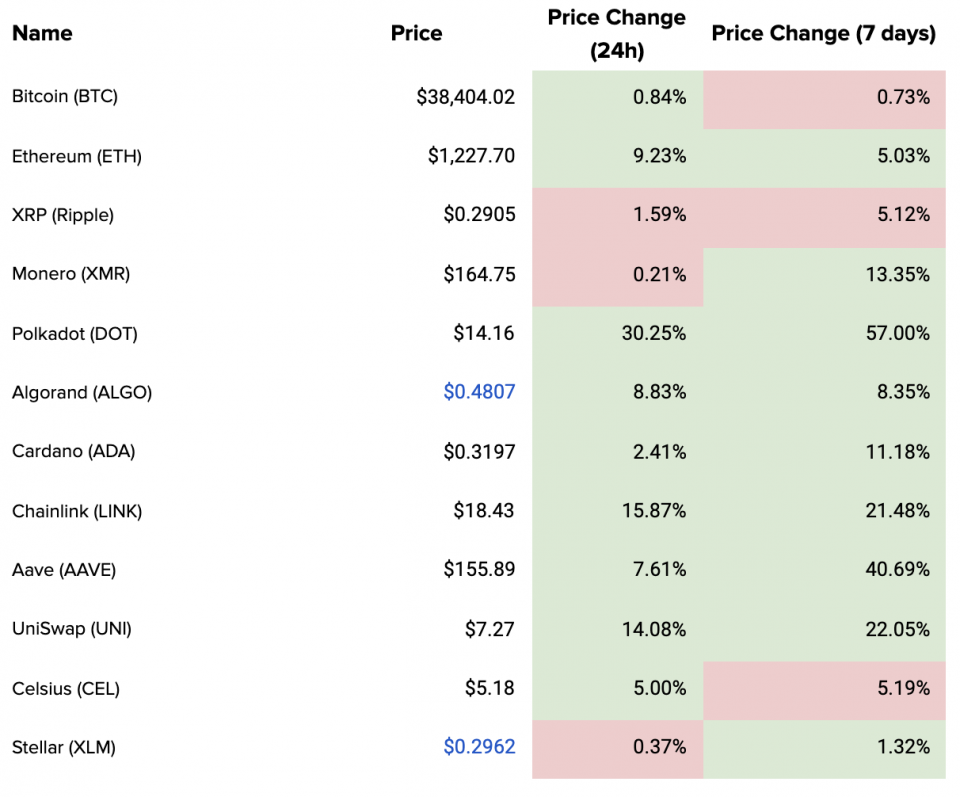

Crypto at a Glance

Bitcoin came back within striking distance of $40,000 again yesterday and has now recouped most of its losses from the dip earlier this week. There have been a number of reasons posited for the retrace and subsequent recovery, and it’s likely that a large part of it was simply the natural ebbs of flows of the bull market. The rebound does, however, also correspond with Grayscale reopening its services to new investors on 13 January, Joe Biden announcing his stimulus plans, and Lindsay Lohan giving her punchy $100,000 prediction on Cameo. What do you reckon – part of the cycle or another factor from this snowstorm of bullishness? It was probably Lohan, right? Like a sheep with alopecia, there’s no wool over our eyes.

Elsewhere, Ether is also deep into its recovery and is now back over $1,200. The huge demand for the leading alt coin by market cap is such that it has reportedly created an Ether liquidity crisis, with exchanges rumoured to be running low. What could that mean for price?

The seemingly-inexorable rise of Polkadot also continues apace. DOT has now flipped XRP’s market cap on the majority of analytics platforms. Only Coinmarketcap still has it below XRP, reporting the supply as 10% lower than elsewhere. It was generally a bit of an unreliable day in general yesterday for Coinmarketcap though, which mysteriously briefly had Wrapped Bitcoin down as having flipped Bitcoin to become the leading cryptocurrency in the world by market cap. It’s not, in case you saw it and were still wondering.

In the Markets

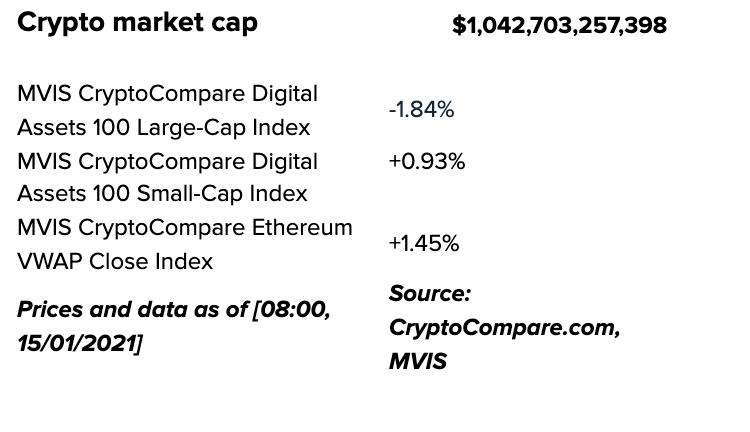

What bitcoin did yesterday

We closed yesterday, 14 January, 2020, at a price of $39,187.33 – up from $37,316.36 the day before. That’s the highest closing price since last Saturday. It’s now 13 days since the price of bitcoin was last below $30,000 and 29 since it was below $20,000.

The daily high yesterday was $39,966.41 and the daily low was $36,868.56.

This time last year, the price of bitcoin closed the day at $8,827.76. That’s a year-on-year increase of 344%. In 2019, it was $3,706.05.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $712,625,057,092, down from $716,091,190,477 yesterday. That means Bitcoin currently has a higher market cap than Facebook, which is at $699.65 billion at the moment. Tesla is at $800.97 billion. Start your engines.

Bitcoin volume

The volume traded over the last 24 hours was $63,585,852,414, down from $65,207,628,346 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 90.54%.

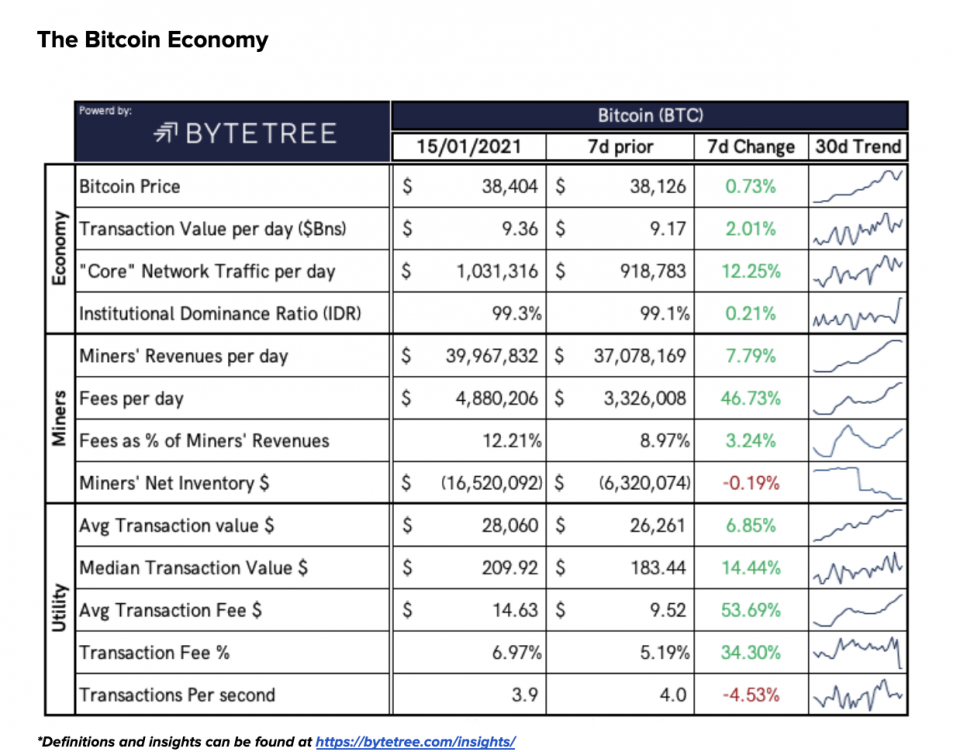

Fear and Greed Index

The Fear and Greed Index is back up to 88 today after a couple of days in the doldrums of slightly-lower Extreme Greed. It’s important to remember that the index doesn’t usually stay this high for very long and this could mean a correction is on the cards, so be vigilant.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 68.94. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 66.81. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

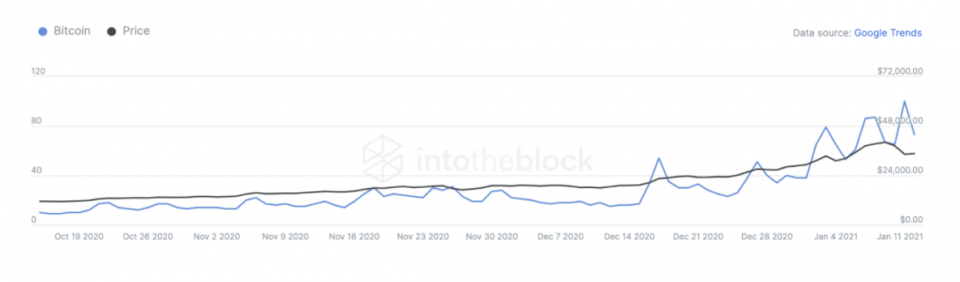

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 73 – taken from 12 January.

Convince your Nan: Soundbite of the day

“In the case of U.S. currency, inflation is baked into the Federal Reserve’s plan for the U.S. dollar. So it’s no wonder that our buying power is eroded […] That will not be the case with bitcoin. Bitcoin provides a more stable value to people who are either saving now to live comfortably in the future but also people who are on fixed income or approaching fixed income now.”

- Cynthia Lummis, US Senator from Wyoming

What they said yesterday…

News of Biden’s proposed stimulus package draws a mixed response…

Thanks, Christine!

Supply and demand

Coming soon on bumper stickers across the land

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno