Environmental populism puts greener future at risk, warns North Sea boss

The Government is damaging the North Sea industry and undermining the UK’s supply security through “environmental populism,” warned the boss of a leading industry body.

Deirdre Michie, chief executive of Offshore Energies UK (OEUK) told City A.M. that “single issue solutions” such as the recently hiked windfall tax will jeopardise the country’s green ambitions, rather than enhancing them.

The industry boss argued that undermining the investment climate domestically would only jeopardise future projects in the North Sea and domestic fossil fuel generation, which she argued were essential for the UK’s energy transition over the coming decades.

This included the shift to future hydrogen and carbon capture facilities from repurposed oil and gas and reduced reliance on carbon intensive fossil fuel vendors from overseas over the coming decades.

She said: “Environmental populism, which I think is concerning, is not going to solve the issues that we have today. Stopping our sector tomorrow will not reduce demand. It will just mean we have to increase our imports that come with a higher emissions input.

“That’s where I do find myself going: ‘Don’t you get the irony of shutting down the sector? Losing the jobs? Losing the investment? Losing the companies which will drive energy transition and cut the emissions.'”

Controversy surrounding continued oil and gas exploration remains topical amid sustained Just Stop Oil protests and calls from high-profile climate groups such as the International Energy Agency to stop further oil and gas developments worldwide to meet the climate targets included in the Paris Agreement.

Commenting on Just Stop Oil protests, Michie said she supported their right to protest but argued the irony was “we all want the same outcome.”

She explained: “From our perspective, we are absolutely committed to delivering the right outcome and are working on the solutions to do that. I’d like us to work with Just Stop Oil and show them we are actually trying to do the right thing.”

Michie noted that OEUK was one of the first industrial sectors to come out in support of net zero with specific emissions reduction targets including 20 per cent cuts by 2030 and 30 per cent reductions by 2040.

North Sea oil and gas sector faces decline

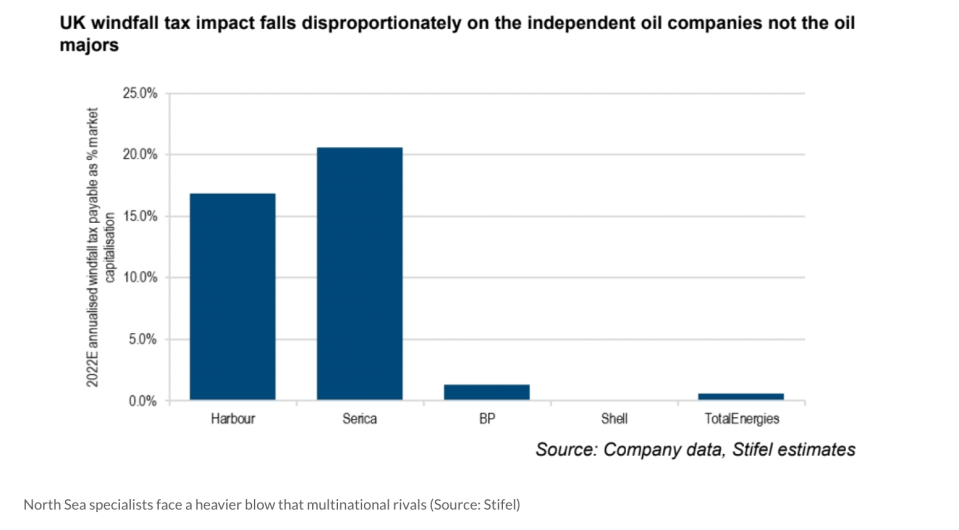

Chancellor Jeremy Hunt hiked the Energy Profits Levy from 25 per cent to 35 per cent last month, and extended its duration from three years to six – with the tax now not set to end until 2028.

This is on top of the 40 per cent special rate that North Sea oil and gas companies were already expected to pay.

The levy was introduced to harness record profits across the domestic oil and gas sector to fund household and business support packages amid soaring energy bills.

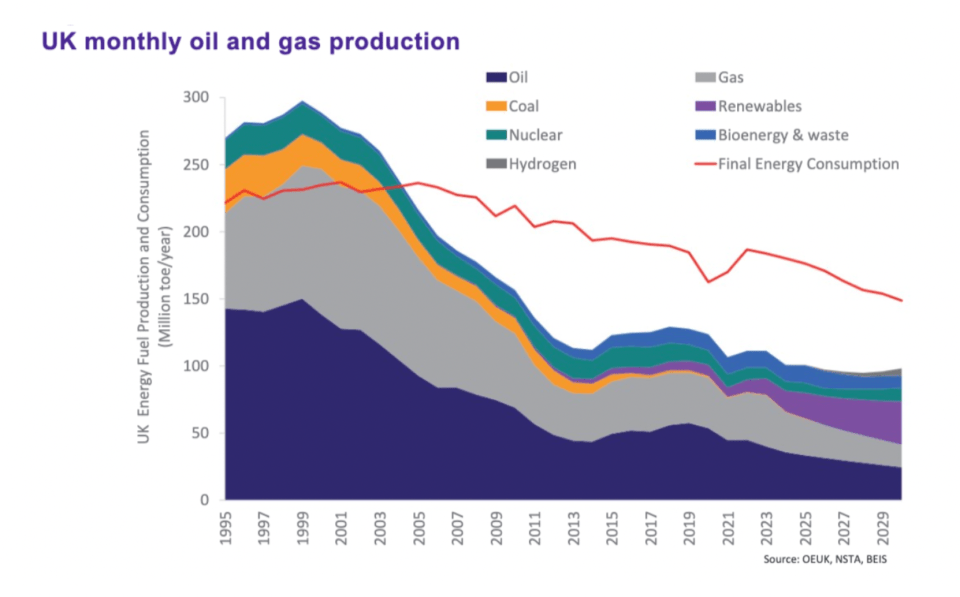

In its recent economic report, OEUK has calculated that without further investment in the North Sea, the UK’s production is likely to decline at a rate of around 15 per cent per year for the remainder of the decade.

This would leave the UK dependent on international imports for around 80 per cent of gas needs and around 70 per cent for oil by 2030, becoming increasingly reliant on overseas partners such as Norway and highly carbon intensive liquefied natural gas from Qatar and the US.

Currently, domestic supplies help meet around 45 per cent of the UK’s oil and gas needs.

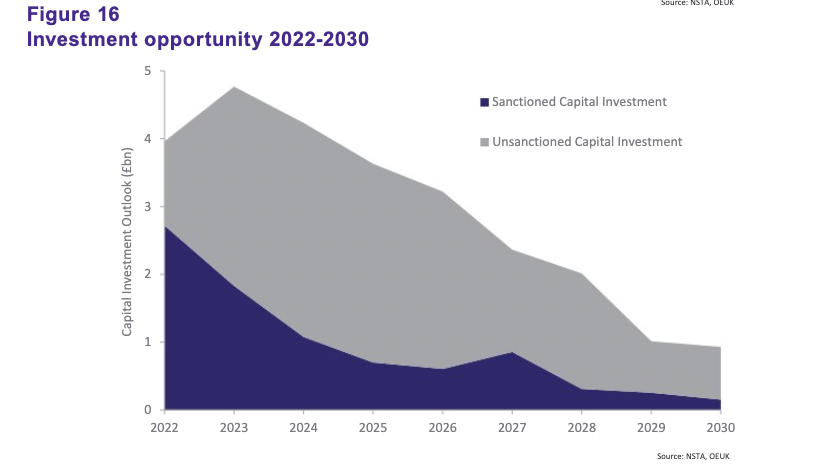

OEUK has predicted that as much as 4bn barrels of oil and gas could be extracted from the North Sea, which could reduce production decline to around five per cent per year.

However, there are growing doubts over whether such exploration will take place to exploit the resources.

The Government has included domestic oil and gas exploration in its energy security strategy, and investment relief worth up to 91p in the pound has been included in the Energy Profits Levy.

Nevertheless, the effects of the hiked tax are already being felt in the industry with Total Energies slashing £100m from its UK investment plans, while the weaker forecast for the North Sea has seen Harbour Energy fall out of the FTSE 100 earlier this month.

Michie described the hiked levy as a “tax too far,” with Hunt meeting North Sea executives last week.

City A.M. understands they are calling for the windfall tax to be eased in line with falling oil and gas prices, to prevent oil and gas operators collapsing.

Commenting on the latest industry volatility, she said: “I think it’s very much about investor confidence. I think it’s the shock of having a two windfall taxes within short order. That’s what has really challenged the confidence of the sector.”

She also noted the North Sea industry is a “long-term” investments industry – meaning that the appeal of investment relief was tarnished by the two year window before the next election.

Opposition parties, including Labour, have called for the levy to be toughened further and for investment relief to be scrapped.

Michie is set to step down from her role as chief executive at the end of the year, and her replacement has not yet been named.

In contrast to the uncertainty at board room, she was certain the industry could work with Government to try and resolve the current volatility in the domestic industry.

She said: ‘I am quite optimistic that it can be [resolved] because I’ve seen it. I’ve seen us work together to address things when they’ve been an issue before.

“I think there’s so much to play for. I think the opportunity for this sector in terms of its evolution – in terms of new energies – is massive. But the UK has got to get out there and got to start gripping it to make sure we can realise it. So, I tend to be more positive than negative about how it evolves going forward.”