Dresdner sale gets interest of UK broker

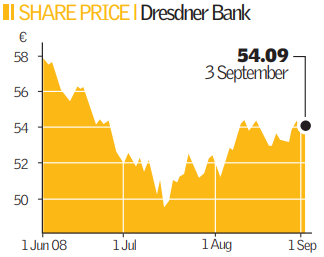

British broker Collins Stewart is circling Dresdner Kleinwort, after Commerzbank admitted it would shrink the investment bank as part of its €9.8bn (£7.9bn) deal for fellow German bank Dresdner.

Collins Stewart, itself the subject of a takeover approach from Japanese group Nomura Holdings, is thought to be eyeing several Dresdner Kleinwort businesses, including its advisory service, capital markets business and equity trading unit.

Commerzbank has admitted that it does not have an interest in maintaining a large investment banking operation in London, which could leave the way clear for a sale to suit all parties.

Collins Stewart, led by Terry Smith, would see the advisory unit as a valuable addition to its Hawkpoint corporate finance operation, while the capital markets and equity trading businesses would marry up well with the firm’s broking operations.

Nomura Holdings could back a move by Collins Stewart or even bypass the broker entirely and table a bid for Dresdner Kleinwort itself.

Another possible outcome is that other banks move in to recruit some of Dresdner Kleinwort’s highly regarded staff, with Barclays likely to be among the interested parties.

Dresdner Kleinwort chief executive Stefan Jentzsch stepped down last Tuesday. Meanwhile, it emerged yesterday that Allianz would take a write-down of €1.2bn after the sale of Dresdner, because of deferred tax assets it will no longer be able to use.