Don’t be spooked by inflation: there are ways to protect your portfolio

Clever investors can protect themselves from the worst effects of rising prices, says Esther Shaw

Figures out last week showed that inflation in the UK, as measured by the Consumer Price Index (CPI), jumped to 4.4 per cent in July, more than double the Government’s 2 per cent target. On other measures, the figure is far higher.

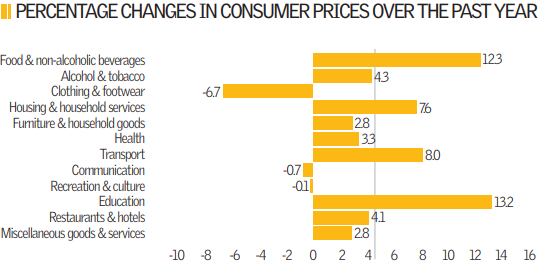

The Retail Price Index (RPI), the official measure of how much goods and services bought by the average UK household changes and which includes mortgage interest payments and reflects movements in house prices and accommodation costs, is at 5 per cent. The price of food has increased 13.7 per cent in the past year.

There are tough times ahead. But there are steps you can take to shelter your portfolio from an environment of rising prices. One of the best places to start is with index-linked gilts which offer a guaranteed return over the RPI.

National Savings & Investments (NS&I) offers index-linked savings certificates which are tax-free and pay 1 per cent over RPI. “If we assume a 4 per cent figure for RPI, the current interest on the three and five year accounts would be 5 per cent, representing a gross equivalent for higher-rate taxpayers of around 8.33 per cent which is fantastic,” says Jason Witcombe, from wealth management group Evolve Financial Planning.

As they are backed by the government, these are safe and are a good way of increasing the net return on your cash holdings and diversifying the underlying credit risk at the same time.

Long-term

That said, some argue that the markets have already priced in inflation rising above 5 per cent, and so options such as index-linked gilts may offer little value.

Phil Collins, fund manager of Newton Investment Management’s Phoenix Multi-Asset fund says that inflation generally benefits commodity investors, while equity investment provides protection from inflation.

He suggests buying exposure to commodities – either through an Exchange Traded Fund (ETF) that tracks a commodity, or a managed fund.

There are also a number of equities that are likely to benefit from rising commodity prices, such as mining and oil companies, he says.

A good tactic is to invest in things whose value is affected by the key drivers of inflation – most recently, energy and food. Jonathan Brownlow of wealth management group The Route, says, “Significant gains have already been observed in the area of agricultural commodities, and although the price of oil is starting to come off slightly, it is projected that global energy demand will continue to rise for the foreseeable future. Plus, with increasing challenges to the supply chain, it is likely that energy costs will push inflation still higher.”

That said, if you do decide to go down the commodities route, then you need to be aware of those sectors which are most susceptible to reduced demand as the US dollar rebounds and the global economy gradually cools.

“In equities, companies or sectors with clear pricing power and, in the current credit crunch environment, a low degree of leverage, will insulate you best from inflation,” says says Rebecca O’Keefe from Interactive Investor.

Another option worth considering, according to Kate Warne, market strategist with stockbroker Edward Jones, is a rising-income portfolio of shares in companies that historically have increased their dividends.

“To address both today’s higher prices and longer-term inflation, consider equities with a track record of dividend increases and which are expected to continue increasing their dividends in the future,” she says.

Historically, she adds, dividend increases have exceeded the rate of inflation.

Direct Hedge

“During the past 10 years, dividends rose 13.9 per cent on average – well above today’s high inflation rate,” she says. “While dividends may be increased, decreased or eliminated without warning, they have solved many investors’ needs for additional income to pay bills.”

Elsewhere, Christian Gattiker-Ericsson from Julius Baer Investment recommends that in such an environment, a “more direct hedge” against inflation should be built into portfolios by investing in real estate or market-neutral financial investments, like hedge funds.

“Their prices tend to adjust more more quickly to inflation and move in line with the overall price level,” he says. “This provides a good hedge against the loss of purchasing power.”

In emerging markets, he adds, Julius Baer concentrates on development companies active in areas with a resilient demand outlook, but where capacities remain subdued, such as Russia and some Eastern European countries.

Emerging Economies

At the same time, the long-term case for many of the major emerging market commodity producer remains as strong as it ever was.

As Andrew Cole, director of asset allocation at Barings Asset Management, says, “China has slowed the economy ahead of the Olympics, but going forward, we expect the Chinese authorities and other emerging economies to reaccelerate.”

He adds that investors may want to consider gold, which is an inflation hedge that can preserve purchasing power – particularly at a time when there are doubts over central banks.

At the end of the day, in order to effectively hedge against inflation, investors need to consider longer-term investments.

Diversification is key, so let your asset allocation perform for you – but clever investors should be ready to weather some under-performance short term in order to fully protect themselves from inflation in the medium to long-term.